Question: Problem 4-1A Applying the accounting cycle LO C1, C2, P2, P:3 On April 1, 2017, Jiro Nozomi created a new travel agency, Adventure Travel. The

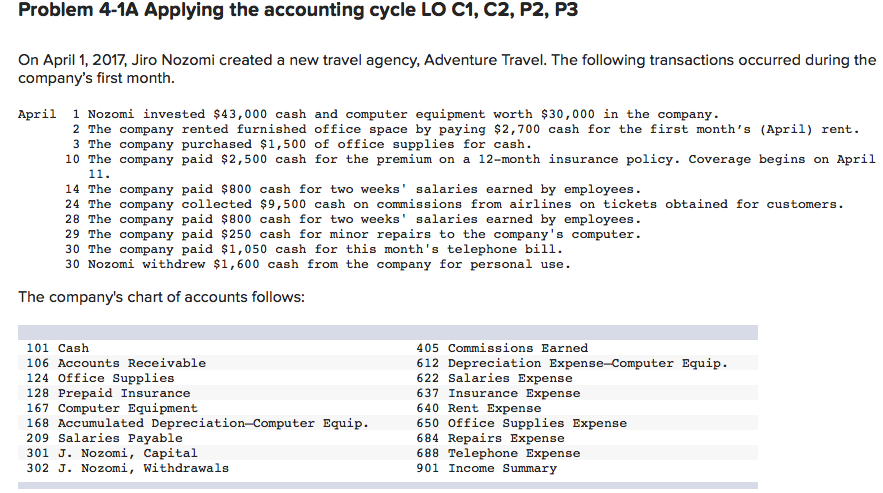

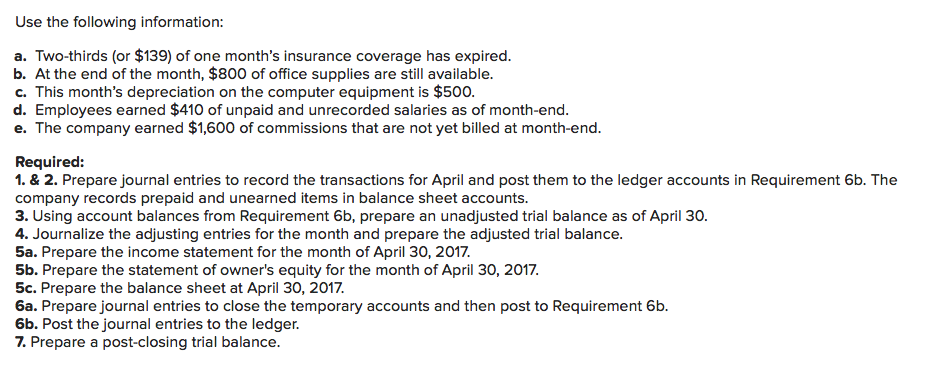

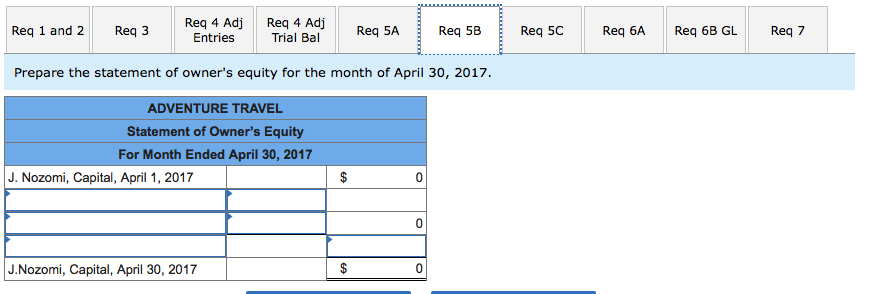

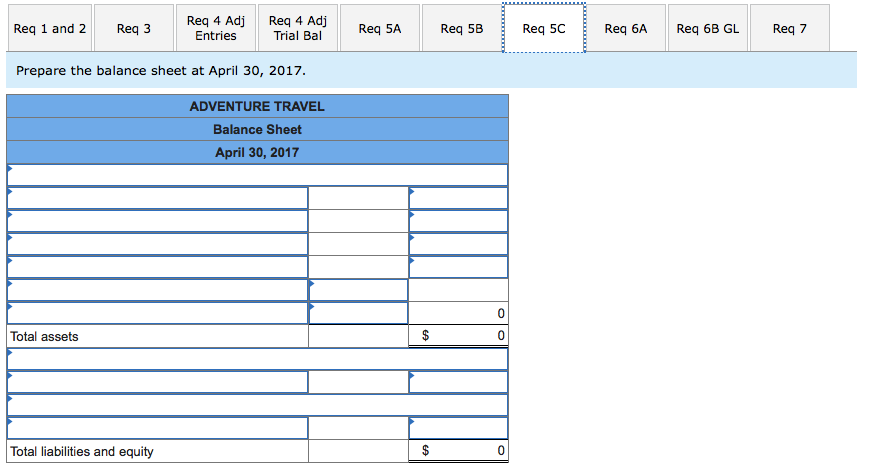

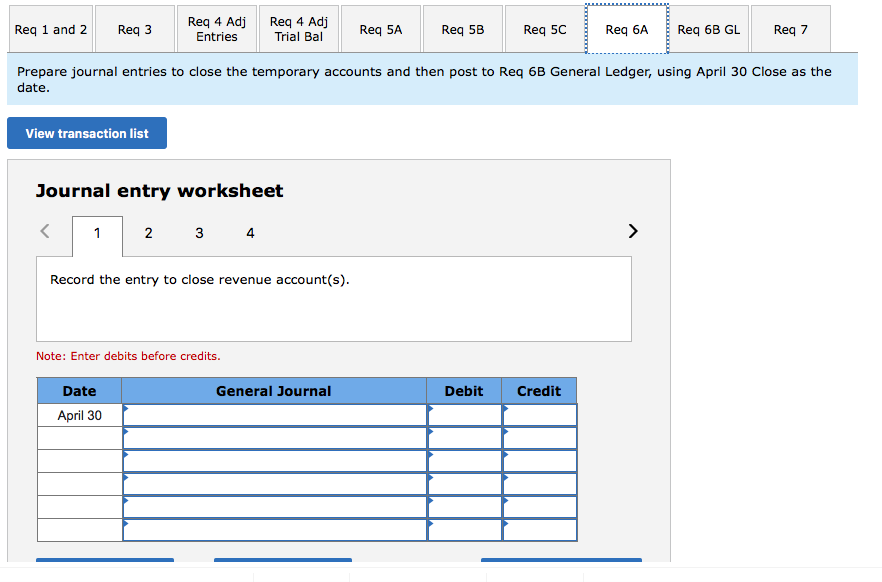

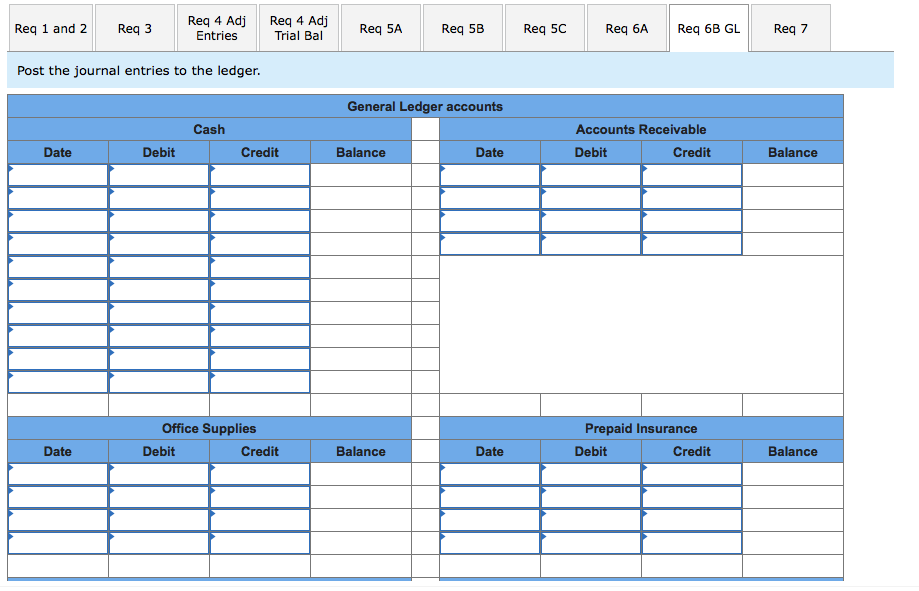

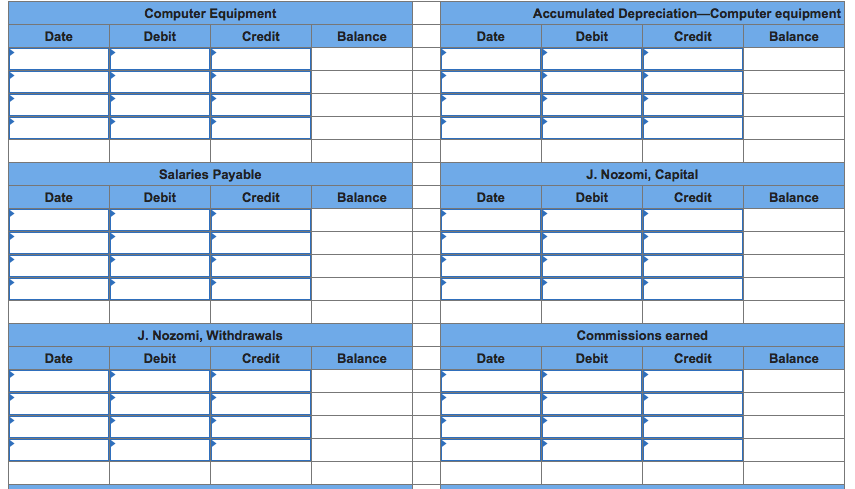

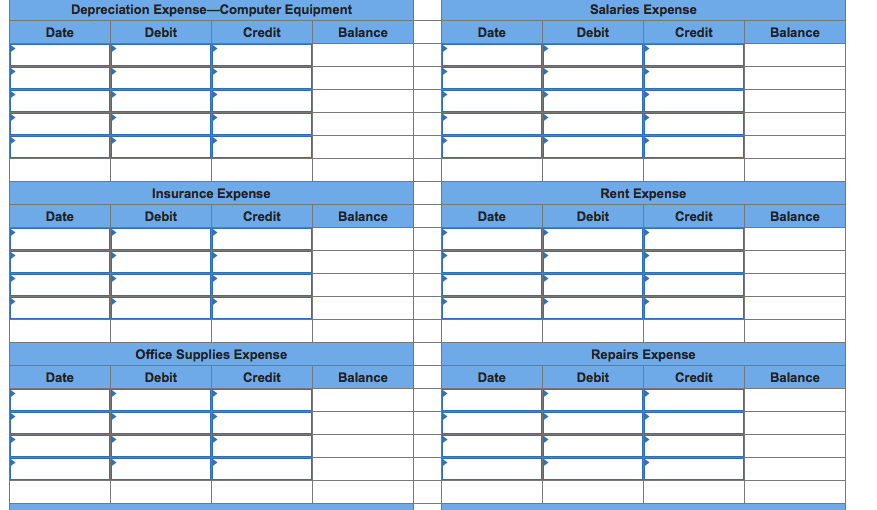

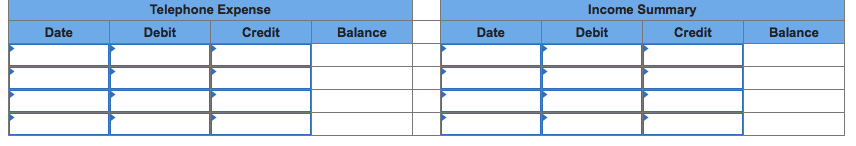

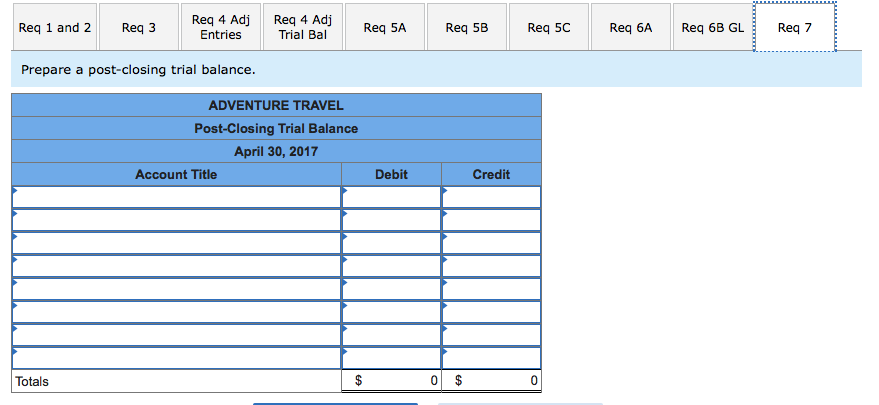

Problem 4-1A Applying the accounting cycle LO C1, C2, P2, P:3 On April 1, 2017, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's first month April 1 Nozomi invested $43,000 cash and computer equipment worth $30,000 in the company. 2 The company rented furnished office space by paying $2,700 cash for the first month's (April) rent. 3 The company purchased $1,500 of office supplies for cash 10 The company paid $2,500 cash for the premium on a 12-month insurance policy. Coverage begins on April 14 The company paid $800 cash for two weeks' salaries earned by employees 24 The company collected $9,500 cash on commissions from airlines on tickets obtained for customers 28 The company paid $800 cash for two weeks' salaries earned by employees. 29 The company paid $250 cash for minor repairs to the company's computer 30 The company paid $1,050 cash for this month's telephone bill. 30 Nozomi withdrew $1,600 cash from the company for personal use The company's chart of accounts follows 101 Cash 106 Accounts Receivable 124 Office Supplies 128 Prepaid Insurance 167 Computer Equipment 168 Accumulated Depreciation-Computer Equip. 209 Salaries Payable 301 J. Nozomi, Capital 302 J. Nozomi, Withdrawals 405 Commissions Earned 612 Depreciation Expense-Computer Equip. 622 Salaries Expense 637 Insurance Expense 640 Rent Expense 650 Office Supplies Expense 684 Repairs Expense 688 Telephone Expense 901 Income Summary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts