Question: Problem 4-2 (Algorithmic) What is a Capital Asset?, Holding Period, Calculation of Gain or Loss, and Net Capital Gains (LO 4.1, 4.2, 4.3, 4.5) During

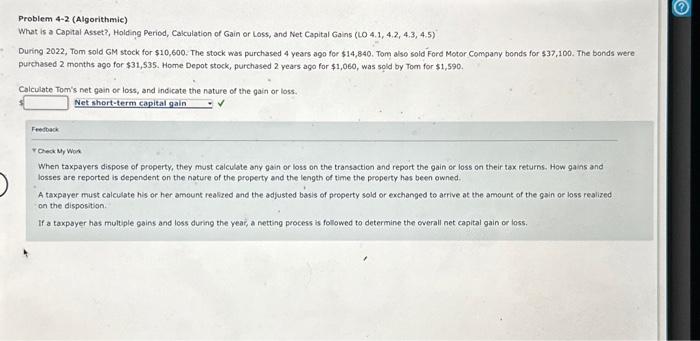

Problem 4-2 (Algorithmic) What is a Capital Asset?, Holding Period, Calculation of Gain or Loss, and Net Capital Gains (LO 4.1, 4.2, 4.3, 4.5) During 2022, Tom sold GM stock for $10,600. The stock was purchased 4 years ago for $14,840. Tom also sold Ford Motor Company bonds for $37,100. The bonds were purchased 2 months ago for $31,$35. Home Depot stock, purchased 2 years ago for $1,060, was sold by Tom for $1,590. Calculate Tom's net gain or loss, and indicate the nature of the gain or loss. 1. Fentoack rowervy wos When taxpayers dispose of property, they must calculate any gain or loss on the transaction and report the gain or loss on their tax returnis. How gains and losses are reported is dependent on the nature of the property and the length of time the property has been owned. A taxpayer must calculate his or her amount realized and the adfusted basis of peoperty sold or exchanged to arrive at the amount of the gain or loss realized. on the disposition. If a taxpayer has multiple gains and loss during the year, a netting process is followed to determine the overall net capital gain or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts