Question: Problem 4.2. Calculate the credit default swap spread for a 3-year CDS where the spread is paid at the end of each year and the

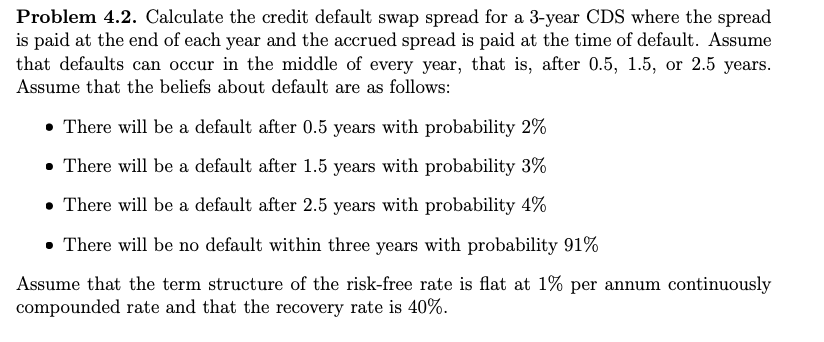

Problem 4.2. Calculate the credit default swap spread for a 3-year CDS where the spread is paid at the end of each year and the accrued spread is paid at the time of default. Assume that defaults can occur in the middle of every year, that is, after 0.5, 1.5, or 2.5 years. Assume that the beliefs about default are as follows: There will be a default after 0.5 years with probability 2% There will be a default after 1.5 years with probability 3% There will be a default after 2.5 years with probability 4% There will be no default within three years with probability 91% Assume that the term structure of the risk-free rate is flat at 1% per annum continuously compounded rate and that the recovery rate is 40%. Problem 4.2. Calculate the credit default swap spread for a 3-year CDS where the spread is paid at the end of each year and the accrued spread is paid at the time of default. Assume that defaults can occur in the middle of every year, that is, after 0.5, 1.5, or 2.5 years. Assume that the beliefs about default are as follows: There will be a default after 0.5 years with probability 2% There will be a default after 1.5 years with probability 3% There will be a default after 2.5 years with probability 4% There will be no default within three years with probability 91% Assume that the term structure of the risk-free rate is flat at 1% per annum continuously compounded rate and that the recovery rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts