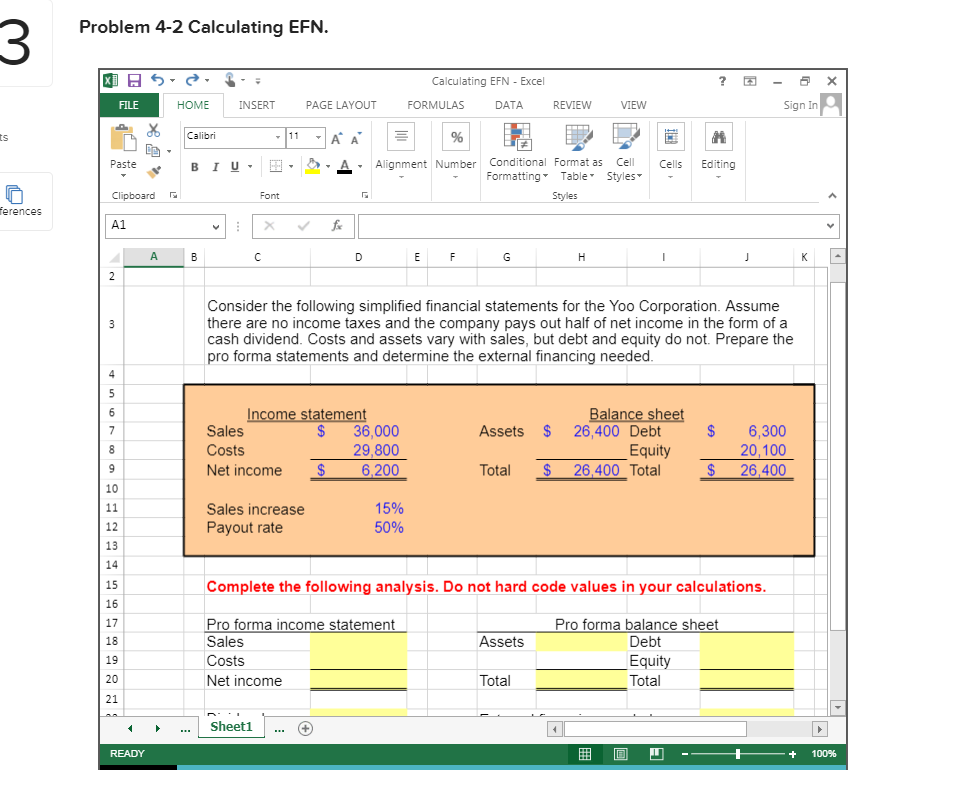

Question: . Problem 4-2 Calculating EFN Calculating EFN - Excel HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In O6Calibri AAlignment Number Conditional Format as

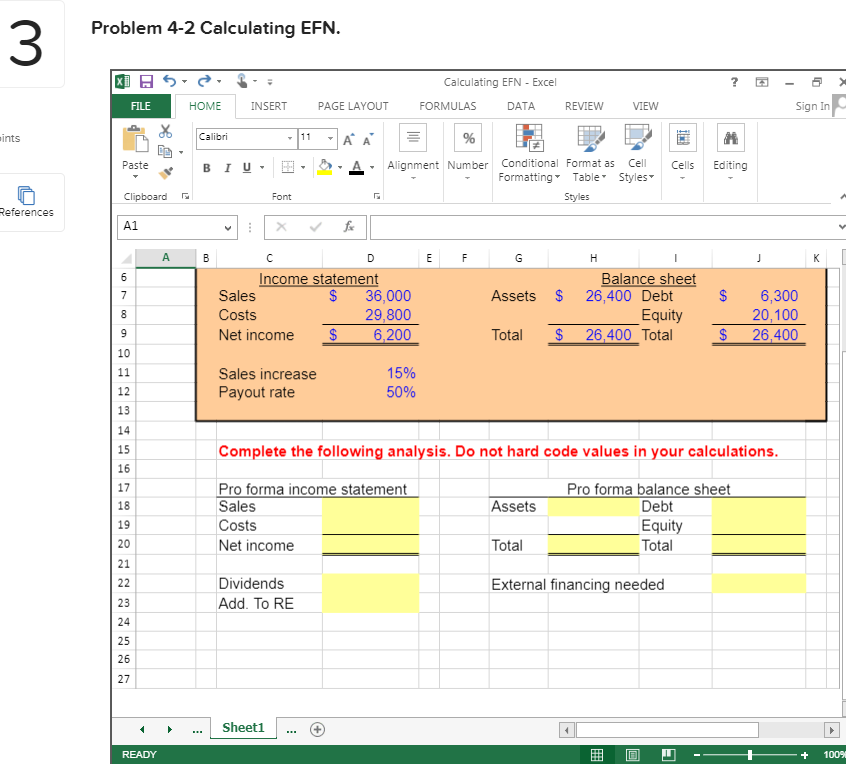

. Problem 4-2 Calculating EFN Calculating EFN - Excel HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In O6Calibri AAlignment Number Conditional Format as Cell Cells Editing Paste FormattingTable Styles- erences A1 Consider the following simplified financial statements for the Yoo Corporation. Assume there are no income taxes and the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not. Prepare the pro forma statements and determine the external financing needed $ 36,000 Sales Costs Net income$ Assets $ 26,400 Debt $ 6,300 Equity 20 100 $ 26,400 Total 26,400 Total 10 15% 50% Sales increase Payout rate 12 13 15 16 17 18 19 Complete the following analysis. Do not hard code values in your calculations Pro forma income statement Sales Costs Net income Pro forma balance sheet Assets Debt Equity 21 Sheet... t ..S + 100% 3 Problem 4-2 Calculating EFN Calculating EFN - Excel HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In O6Calibri ints Alignment Number Conditional Format as. Cell Formatting Table" Styles Paste Cells Editing B 1 u Clipboard Font eferences A1 Income statement Balance shee Sales Costs Net income $ 6,200 S 36,000 29,800 Assets 26,400 Debt S 6,300 Equity 100 20,100 Total$ 26,400 Total $ 26,400 10 15% 50% Sales increase Payout rate 12 13 14 15 16 17 18 19 20 21 Complete the following analysis. Do not hard code values in your calculations Pro forma income statement Sales Costs Net income Pro forma balance sheet Assets Total External financing needed Debt ul Total = Dividends Add. To RE 23 24 25 26 27 Sheet... t ..S - + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts