Question: Problem 4-2 (LO 2) 80%, cost, beginning and ending inventory. On April 1, 2015, Benton Corporation purchased 80% of the outstanding stock of Crandel Company

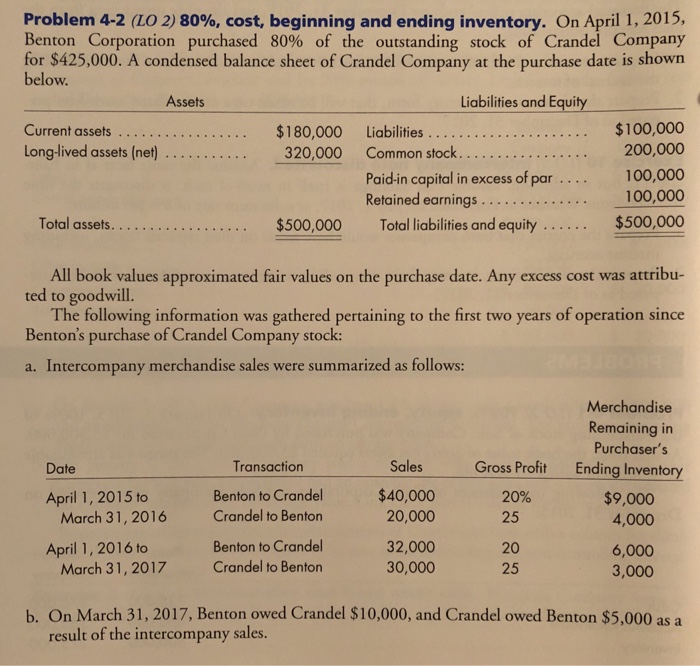

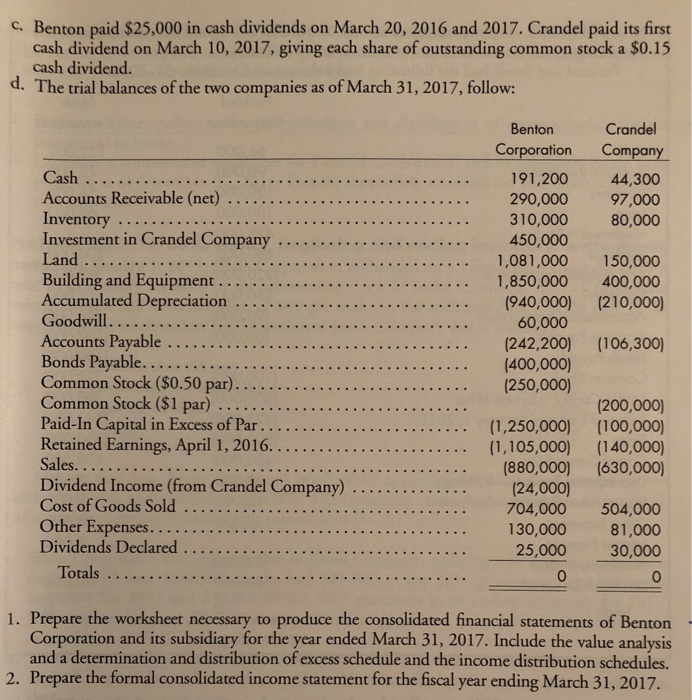

Problem 4-2 (LO 2) 80%, cost, beginning and ending inventory. On April 1, 2015, Benton Corporation purchased 80% of the outstanding stock of Crandel Company for $425,000. A condensed balance sheet of Crandel Company at the purchase date is shown below Assets Liabilities and Equity Current assets . $100,000 200,000 Paid-in capital in excess of par100,000 100,000 Retained earnings All book values approximated fair values on the purchase date. Any excess cost was attribu- ted to goodwill. The following information was gathered pertaining to the first two years of operation since Benton's purchase of Crandel Company stock a. Intercompany merchandise sales were summarized as follows: Merchandise Remaining in Purchaser's Sales Gross Profit Ending Inventory Transaction Benton to Crandel Crandel to Benton Benton to Crandel Crandel to Benton Date $40,000 20% 25 20 25 $9,000 4,000 6,000 3,000 April 1, 2015 to 20,000 32,000 30,000 March 31,2016 April 1, 2016 to March 31, 2017 b. On March 31, 2017, Benton owed Crandel $10,000, and Crandel owed Benton $5,000 as a result of the intercompany sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts