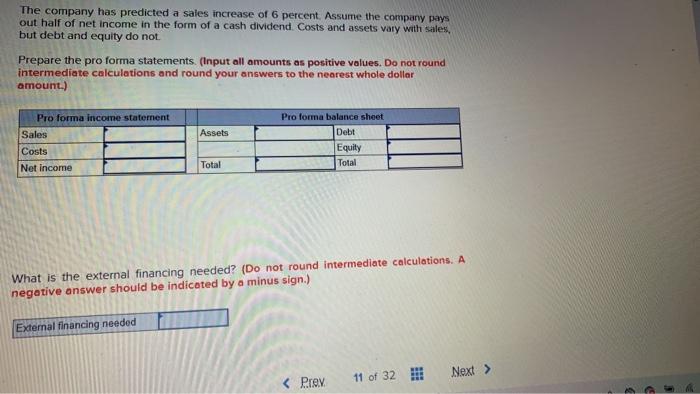

Question: Problem 4-2 Pro Forma Statements and EFN [LO1, 2] Consider the following simplified financial statements for the Wims Corporation (assuming no income taxes): Income Statement

![Problem 4-2 Pro Forma Statements and EFN [LO1, 2] Consider the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f816594f75c_68066f81658e5725.jpg)

Problem 4-2 Pro Forma Statements and EFN [LO1, 2] Consider the following simplified financial statements for the Wims Corporation (assuming no income taxes): Income Statement Balance Sheet Sales $29,300 Assets $22,500 Debt $ 6,000 Costs 22,870 Equity 16,500 Net income $ 6,430 Total $22,500 Total $22,500 The company has predicted a sales increase of 6 percent. Assume the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not Prepare the pro forma statements. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to the nearest whole dollar amount.) Pro forma balance sheet Debt Equity Pro forma income statement Sales Costs Assets 11 of 32 33 Next > ENO Prey 0 The company has predicted a sales increase of 6 percent. Assume the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not. Prepare the pro forma statements. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to the nearest whole dollar amount.) Assets Pro forma income statement Sales Costs Net Income Pro forma balance sheet Debt Equity Total Total What is the external financing needed? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) External financing needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts