Question: Problem 4-20 Amortization Schedule Consider a $25,000 loan to be repaid in equal installments at the end of each of the next 5 years. The

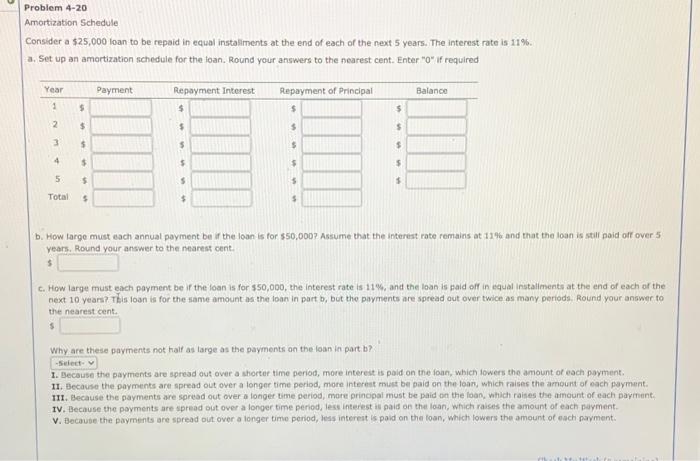

Problem 4-20 Amortization Schedule Consider a $25,000 loan to be repaid in equal installments at the end of each of the next 5 years. The interest rate is 11%. a. Set up an amortization schedule for the foan. Round your answers to the nearest cent. Enter "0" If required Year Payment Repayment Interest Balance Repayment of Principal $ 1 $ $ $ 2 $ $ $ $ 3 $ $ $ $ 4 $ $ $ 5 $ 5 Total $ $ b. How large must each annual payment be if the loan is for $50,0007 Assume that the interest rate remains at 11% and that the loan is still paid off over 5 years. Round your answer to the nearest cent. 5 C. How large must each payment be the loan is for $50,000, the interest rate is 11%, and the loan is paid off in equal installments at the end of each of the next 10 years? This loan is for the same amount as the loan in part b, but the payments are spread out over twice as many periods, Round your answer to the nearest cent. 5 Why are these payments not half as large as the payments on the loan in part b? -Select 1. Because the payments are spread out over a shorter time period, more interest is paid on the loan, which lowers the amount of each payment 11. Because the payments are spread out over a longer time period, more interest must be paid on the loan, which raises the amount of each payment TII. Because the payments are spread out over a longer time period, more principal must be paid on the loan, which raises the amount of each payment IV. Because the payments are spread out over a longer time period, less interest is paid on the loan, which raises the amount of each payment. V. Because the payments are spread out over a longer time period, less interest is paid on the foon, which lowers the amount of each payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts