Question: Problem 4-20 Two-stage DCF model Compost Science Inc. (CSI) is in the business of converting Boston's sewage sludge into fertilizer. The business is not in

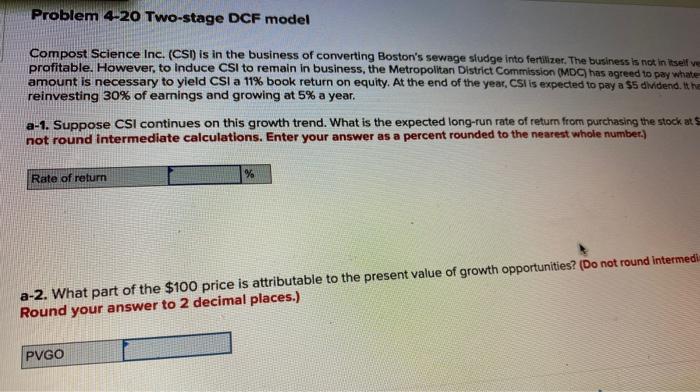

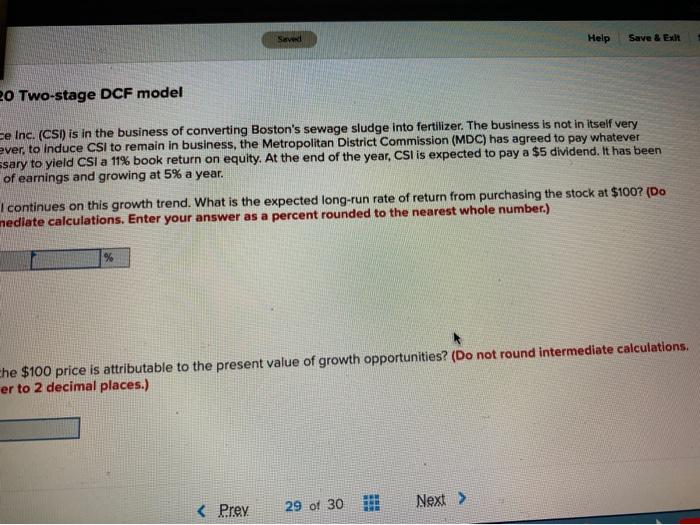

Problem 4-20 Two-stage DCF model Compost Science Inc. (CSI) is in the business of converting Boston's sewage sludge into fertilizer. The business is not in itself ve profitable. However, to induce CSI to remain in business, the Metropolitan District Commission (MDC) has agreed to pay whate amount is necessary to yield CSI a 11% book return on equity. At the end of the year, CSI is expected to pay a S5 dividend the reinvesting 30% of earnings and growing at 5% a year. a-1. Suppose CSI continues on this growth trend. What is the expected long-run rate of return from purchasing the stock ats not round intermediate calculations. Enter your answer as a percent rounded to the nearest whole number.) % Rate of return a-2. What part of the $100 price is attributable to the present value of growth opportunities? (Do not round intermedi Round your answer to 2 decimal places.) PVGO Save Help Save & Ex 20 Two-stage DCF model ce Inc. (CSI) is in the business of converting Boston's sewage sludge into fertilizer. The business is not in itself very ever, to induce CSI to remain in business, the Metropolitan District Commission (MDC) has agreed to pay whatever ssary to yield CSI a 11% book return on equity. At the end of the year, CSI is expected to pay a $5 dividend. It has been of earnings and growing at 5% a year. I continues on this growth trend. What is the expected long-run rate of return from purchasing the stock at $100? (Do nediate calculations. Enter your answer as a percent rounded to the nearest whole number.) % the $100 price is attributable to the present value of growth opportunities? (Do not round intermediate calculations. er to 2 decimal places.) 29 of 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts