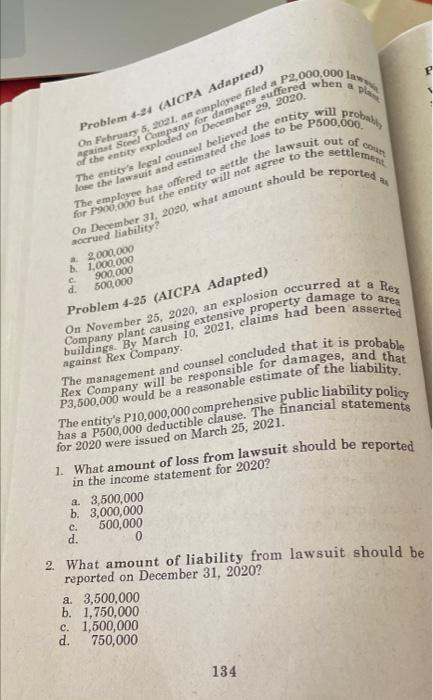

Question: PROBLEM 4-24 - PROBLEM 4-25 P P2,000,000 5 Problem -24 (AICPA Adapted) On February 5, 21. an employee filed a inst Steel Company for damage

P P2,000,000 5 Problem -24 (AICPA Adapted) On February 5, 21. an employee filed a inst Steel Company for damage suffered when of the entity exploded on December 29, 2020 The entity's legal counsel believed the entity will reported The employee has offered to settle the lawsut out of lose the lawsuit and estimated the loss to be P500,000 for P20,000 but the entity will not agree to the settlement On December 31, 2020, what amount should be accrued liability? 2.000.000 1.000.000 900.000 500,000 Problem 4-25 (AICPA Adapted) Rex c. d. On November 25, 2020, an explosion occurred at a Company plant causing extensive property damage to area buildings. By March 10, 2021, claims had been asserted against Rex Company. Rex Company will be responsible for damages, and that The management and counsel concluded that it is probable P3,500,000 would be a reasonable estimate of the liability. The entity's P10,000,000 comprehensive public liability policy has a P500,000 deductible clause. The financial statements for 2020 were issued on March 25, 2021. 1. What amount of loss from lawsuit should be reported in the income statement for 2020? a. 3,500,000 b. 3,000,000 500,000 0 c. d. 2. What amount of liability from lawsuit should be reported on December 31, 2020? a. 3,500,000 b. 1.750,000 c. 1,500,000 d. 750,000 134

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts