Question: Problem 4-27 Percent-of-sales method (L04-3) Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance

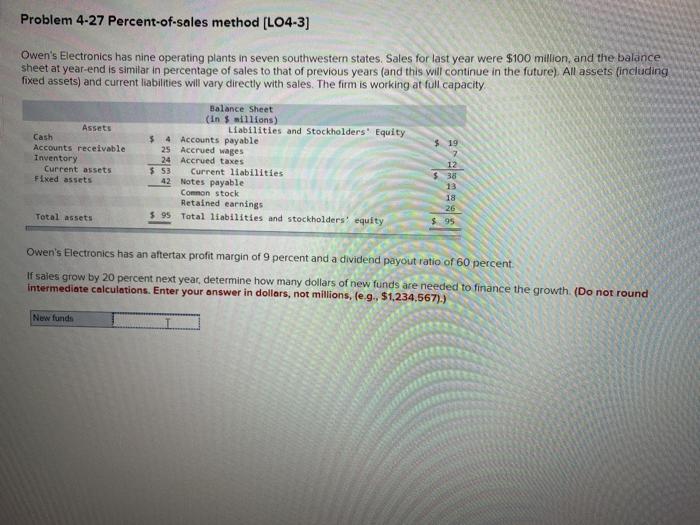

Problem 4-27 Percent-of-sales method (L04-3) Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future) All assets (including fixed assets) and current liabilities will vary directly with sales. The firm is working at full capacity Balance Sheet (in millions) Assets Liabilities and Stockholders' Equity 4 Accounts payable Accounts receivable 25 Accrued wages Inventory 24 Accrued taxes Current assets $53 Current liabilities $38 Fixed assets 42 Notes payable Common stock Retained earnings Total assets $95 Total liabilities and stockholders' equity Cash 5 $19 7 12 13 18 26 $95 Owen's Electronics has an aftertax profit margin of 9 percent and a dividend payout ratio of 60 percent If sales grow by 20 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not round Intermediate calculations. Enter your answer in dollars, not millions, le... $1,234,567).) New funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts