Question: Problem 4-29 (algorithmic) Question Help Liam O'Kelly is 20 years old and is thinking about buying a term life insurance policy with his wife as

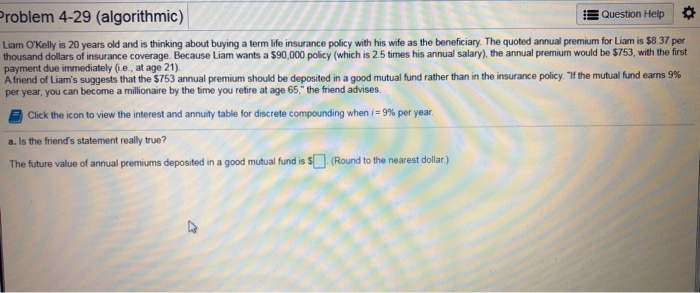

Problem 4-29 (algorithmic) Question Help Liam O'Kelly is 20 years old and is thinking about buying a term life insurance policy with his wife as the beneficiary. The quoted annual premium for Liam is $8.37 per thousand dollars of insurance coverage. Because Liam wants a $90,000 policy (which is 2.5 times his annual salary), the annual premium would be 5753, with the first payment due immediately (ie, at age 21) Afriend of Liam's suggests that the $753 annual premium should be deposited in a good mutual fund rather than in the insurance policy. If the mutual fund earns 9% per year, you can become a millionaire by the time you retire at age 65," the friend advises Click the icon to view the interest and annuity table for discrete compounding when i = 9% per year a. Is the friend's statement really true? The future value of annual premiums deposited in a good mutual fund is (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts