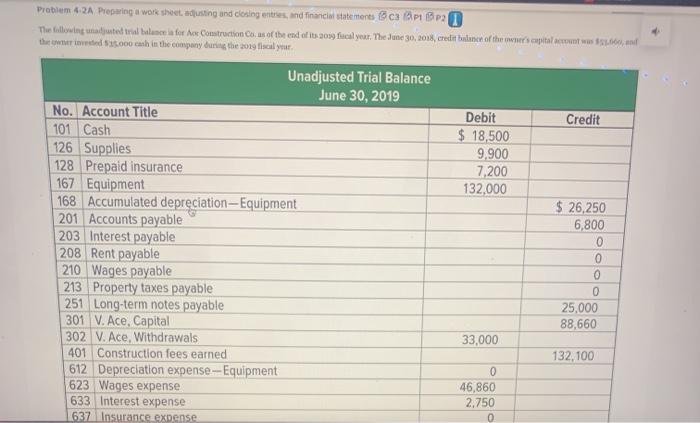

Question: Problem 4.2A Preparing a work sheet, adjusting and closing entries, and financial statements captop The following med trial balance for der Construction Cons of the

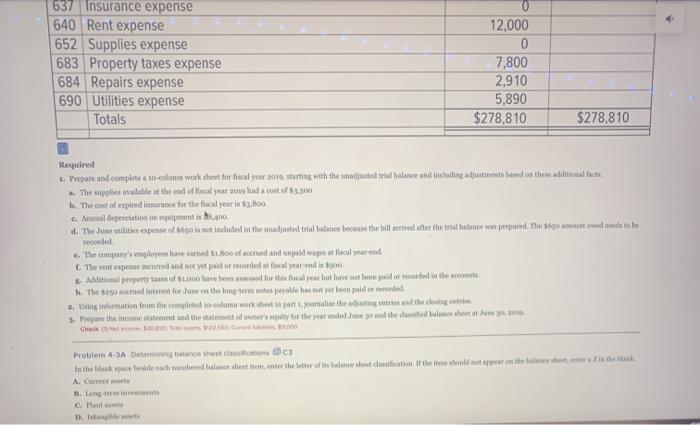

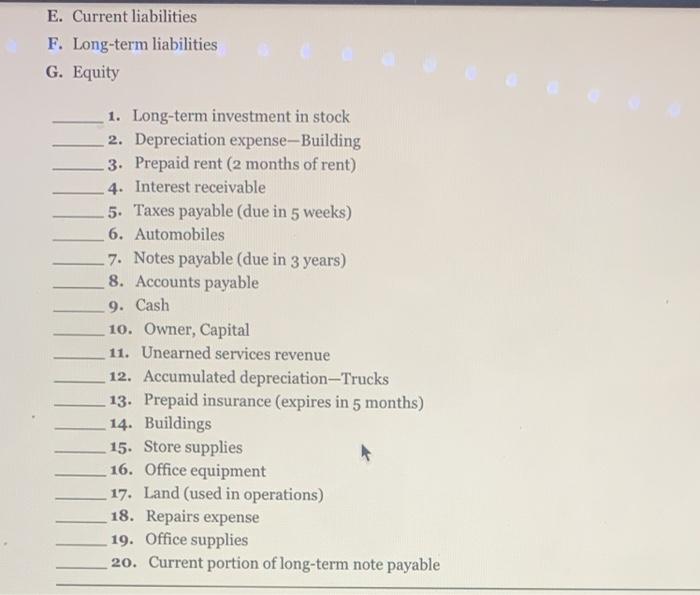

Problem 4.2A Preparing a work sheet, adjusting and closing entries, and financial statements captop The following med trial balance for der Construction Cons of the end of its of year. The June 30, 2015, credit balance of the spitalet, that Wed 1.000 cash in the company during the 2019 fiscal Credit Debit $ 18,500 9.900 7,200 132,000 Unadjusted Trial Balance June 30, 2019 No. Account Title 101 Cash 126 Supplies 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation-Equipment 201 Accounts payable 203 Interest payable 208 Rent payable 210 Wages payable 213 Property taxes payable 251 Long-term notes payable 301 V. Ace, Capital 302 V. Ace, Withdrawals 401 Construction fees earned 612 Depreciation expense-Equipment 623 Wages expense 633 Interest expense 637 Insurance expense $ 26,250 6,800 0 OOO 25,000 88,660 33,000 132.100 0 46,860 2.750 0 637 Insurance expense 640 Rent expense 652 Supplies expense 683 Property taxes expense 684 Repairs expense 690 Utilities expense Totals 12,000 0 7,800 2,910 5.890 $278,810 $278,810 Required 1. Prepare and completu a 10-cola work sheet for hical year 2010, starting with the unadjusted trial balance and including adjustment based on these aditional terms a. The applies available at the end of a year 2010 had a cost of $3.900 b. The cost of expired for the fiscal year is 13.800 c. Am depreciation on equipment is 5.000 de Joselites expense of so la not included in the adjusted trial balance because the bill arrived after the trualne was prepared. The so amount goed weeds to be 6. The company's employees hawwe 1.800 of accrued and unpaid was full The rent expected and not yet or recorded at focal yearend leo. Al property of bave been for this seal year but have not been paid or recorded in the count I The sound interest for the long-term cospetyt eri mund a. ting information from the completed column werk het in parte dingen tegen 3. Popare the newest and the state of wory to the year and Jone and the dealt with Problem 4.A Dengance sheet on in the back speedsheet metatheter in het dateren parteneri Stank Art L-tem C. D. Ioan E. Current liabilities F. Long-term liabilities G. Equity 1. Long-term investment in stock 2. Depreciation expense-Building 3. Prepaid rent (2 months of rent) 4. Interest receivable 5. Taxes payable (due in 5 weeks) 6. Automobiles 7. Notes payable (due in 3 years) 8. Accounts payable 9. Cash 10. Owner, Capital 11. Unearned services revenue 12. Accumulated depreciation-Trucks 13. Prepaid insurance (expires in 5 months) 14. Buildings 15. Store supplies 16. Office equipment 17. Land (used in operations) 18. Repairs expense 19. Office supplies 20. Current portion of long-term note payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts