Question: Problem 4-3 Cullumber Inc, reported income from continuing operations before taxes during 2017 of $803,200. Additional transactions eccurring in 2017 but not considered in the

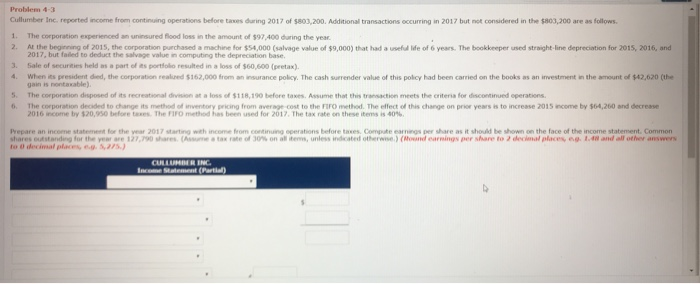

Problem 4-3 Cullumber Inc, reported income from continuing operations before taxes during 2017 of $803,200. Additional transactions eccurring in 2017 but not considered in the $803,200 are as follows 1. The corporation experienced an uninsured flood loss in the amount of $97,400 during the year 2. At the beginning of 2015, the corporation purchased a machine for $54,000 (salvage value of $9,000) that had a usefil Ide of 6 years. The bookkeeper used straight-line depreciation for 2015, 2016, and 3. Sale of securities held as a part of ts portsolio resulted in a loss of $60,600 (pretax) 4 when its presidentdel, the corporation realued S 162,000 from sn nsurance policy. The cash surrender value of this polcy had been camed on the books as an mvestmert n the amount d $42,620 the 5. The corporation disposed of its recreationadivwon at a ss of $1 18, 190 before taxes. Assume ehat this transaction meets th criteria for discominued operations. 6. The corporation decided to change its method of unventory pricing from average cost to the Fro method. The effect of this change on prior years is to increase 2015 "come by 64,260 and decrease 2017, but failed to deduct the salvage value in computing the depreciation base gain is nontaxable) 2016 incerne by $20,950 before taxes. The rIPO method has been used for 2017. The tax rate on these items as 40%. Prepare an income statement for the year 2017 starting with income from continuing operations before taxes Compate eanings er share as it should be shown on the face of the income statement. Common stares outstanding tut the year are 12,) shares. (Assume tax rate of 30% on am terms, unless ndcated otherwise) (ahwand earnings per share to , dwina, place, es 1.4" and all other answers to 0 decimal places7s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts