Question: Problem 4-32 (LO 4-1) (Algo) Through November, Cameron has received gross income of $55,000. For December, Cameron is considering whether to accept one more

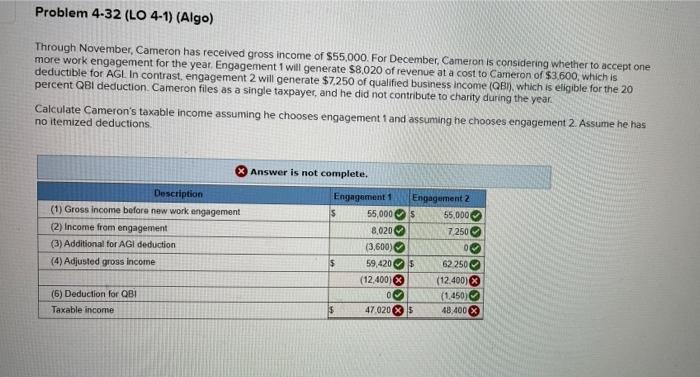

Problem 4-32 (LO 4-1) (Algo) Through November, Cameron has received gross income of $55,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $8,020 of revenue at a cost to Cameron of $3.600, which is deductible for AGL In contrast, engagement 2 will generate $7,250 of qualified business income (QB), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer, and he did not contribute to charity during the year. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions Description (1) Gross income before new work engagement (2) Income from engagement (3) Additional for AGI deduction (4) Adjusted gross income (6) Deduction for QBI Taxable income Answer is not complete. Engagement 1 Engagement 2 S 55,000 $ 55,000 8,020 7,2506 (3,600) O $ 59,420 $ 62 2506 (12,400) (12.400) 0 (1.450) $ 47.0205 48,400x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts