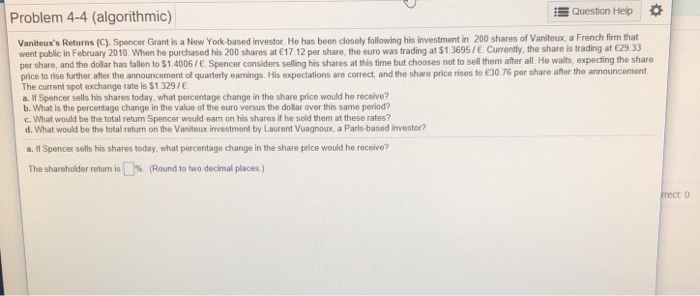

Question: Problem 4-4 (algorithmic) Quest on Help * Vaniteux's Returns (C). Spancer Grant is a New York-based investor. He has been closely following his investment in

Problem 4-4 (algorithmic) Quest on Help * Vaniteux's Returns (C). Spancer Grant is a New York-based investor. He has been closely following his investment in 200 shares of Vaniteux, a French firm that ent public in February 2010 when he pu chased his 200 shares at el 7 12 per share, the euro was trading at $1 3695/e c enty the share s trading at3 per share, and the dollar has fallen to $1.4006/. Spencer considers selling his shares at this time but chooses not to sell them after all. He waits, expecting the share price to rise further afher the announcement of quarterly earmings. His expectations are correct, and the share price rises to 30 76 per share afer the announcement The current spot exchange rate is $1.329/ a. Spencer sells his shares today, what percentage change in the share price would he receive? b. What is the percentage change in the value of the euro versus the dollar over this same perlod? c. What would be the total return Spencer would eam on his shares if he sold them at these rates? d. What would be the total return on the Vaniteux investment by Laurent Vuagnoux, a Paris-based investor? a. If Spencer sells his shares today, what percentage change in the share price would he receive? The shareholder return is 1% (Round to two decinal places.) rect o Problem 4-4 (algorithmic) Quest on Help * Vaniteux's Returns (C). Spancer Grant is a New York-based investor. He has been closely following his investment in 200 shares of Vaniteux, a French firm that ent public in February 2010 when he pu chased his 200 shares at el 7 12 per share, the euro was trading at $1 3695/e c enty the share s trading at3 per share, and the dollar has fallen to $1.4006/. Spencer considers selling his shares at this time but chooses not to sell them after all. He waits, expecting the share price to rise further afher the announcement of quarterly earmings. His expectations are correct, and the share price rises to 30 76 per share afer the announcement The current spot exchange rate is $1.329/ a. Spencer sells his shares today, what percentage change in the share price would he receive? b. What is the percentage change in the value of the euro versus the dollar over this same perlod? c. What would be the total return Spencer would eam on his shares if he sold them at these rates? d. What would be the total return on the Vaniteux investment by Laurent Vuagnoux, a Paris-based investor? a. If Spencer sells his shares today, what percentage change in the share price would he receive? The shareholder return is 1% (Round to two decinal places.) rect o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts