Question: Problem 4-42 Present Value and Break-Even Rate Consider a firm with a contract to sell an asset for $165,000 three years from now. The asset

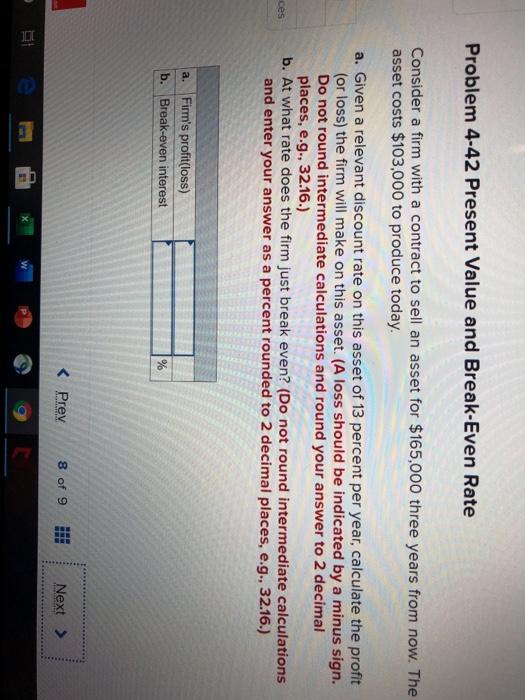

Problem 4-42 Present Value and Break-Even Rate Consider a firm with a contract to sell an asset for $165,000 three years from now. The asset costs $103,000 to produce today. a. Given a relevant discount rate on this asset of 13 percent per year, calculate the profit (or loss) the firm will make on this asset. (A loss should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At what rate does the firm just break even? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ces a. Firm's profit(loss) b. Break-even interest % 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts