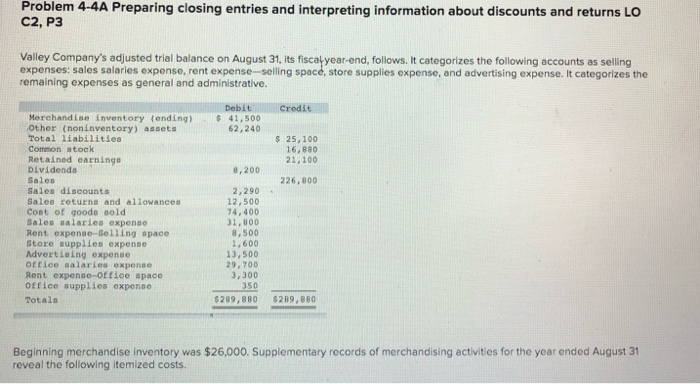

Question: Problem 4-4A Preparing closing entries and interpreting information about discounts and returns LO C2, P3 Valley Company's adjusted trial balance on August 31, its fiscayyear-end,

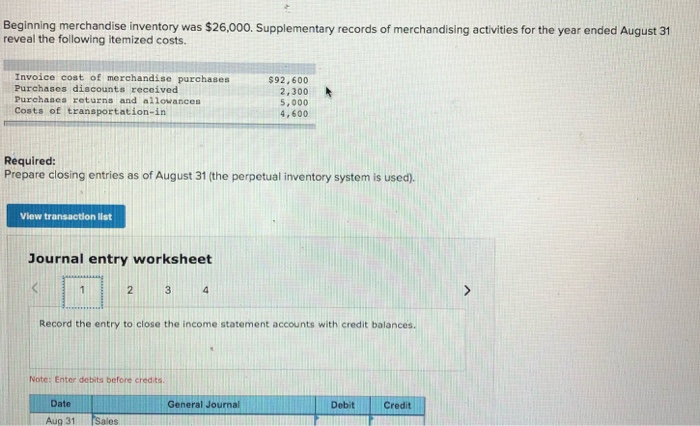

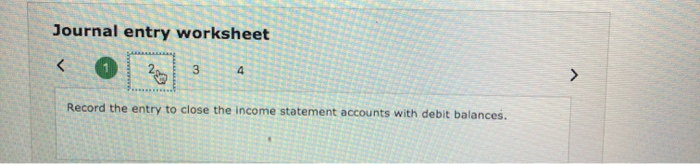

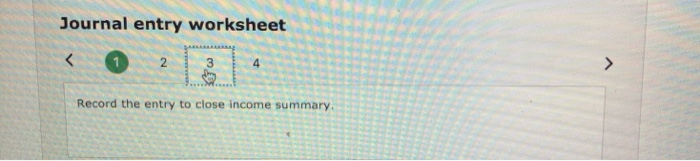

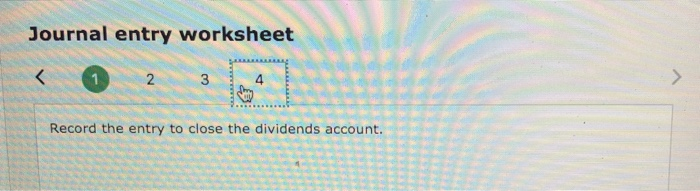

Problem 4-4A Preparing closing entries and interpreting information about discounts and returns LO C2, P3 Valley Company's adjusted trial balance on August 31, its fiscayyear-end, follows. It categorizes the following accounts as seling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Debit Credit Merchandise inventory (ending) $ 41,500 other (noninventory) assets 62,240 Total liabilities $ 25,100 Common stock 16,880 Retained earnings 21,100 Dividends 8,200 Sales 226,800 Sales discounts 2,290 Sales returns and allowances 12,500 Cont of goods sold 74,400 Sales salaries expense 31,800 Rent expense--Selling space 8,500 Store supplies expense 1,600 Advertising expende 13,500 office salaries expenso 29,700 Rent expense-office space 3,300 office supplies expense 350 Total $289,880 $289,880 Beginning merchandise inventory was $26,000. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Beginning merchandise inventory was $26,000. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Invoice cost of merchandise purchases Purchases discounts received Purchases returns and allowances Costs of transportation-in $92,600 2,300 5,000 4,600 Required: Prepare closing entries as of August 31 (the perpetual inventory system is used). View transaction list Journal entry worksheet 2 3 4 > Record the entry to close the income statement accounts with credit balances. Note: Enter debits before credits General Journal Debit Credit Date Aug 31 Sales Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts