Question: Problem 4-54 Calculating Annuities You have recently won the super jackpot in the Washington State Lottery. On reading the fine print, you discover that you

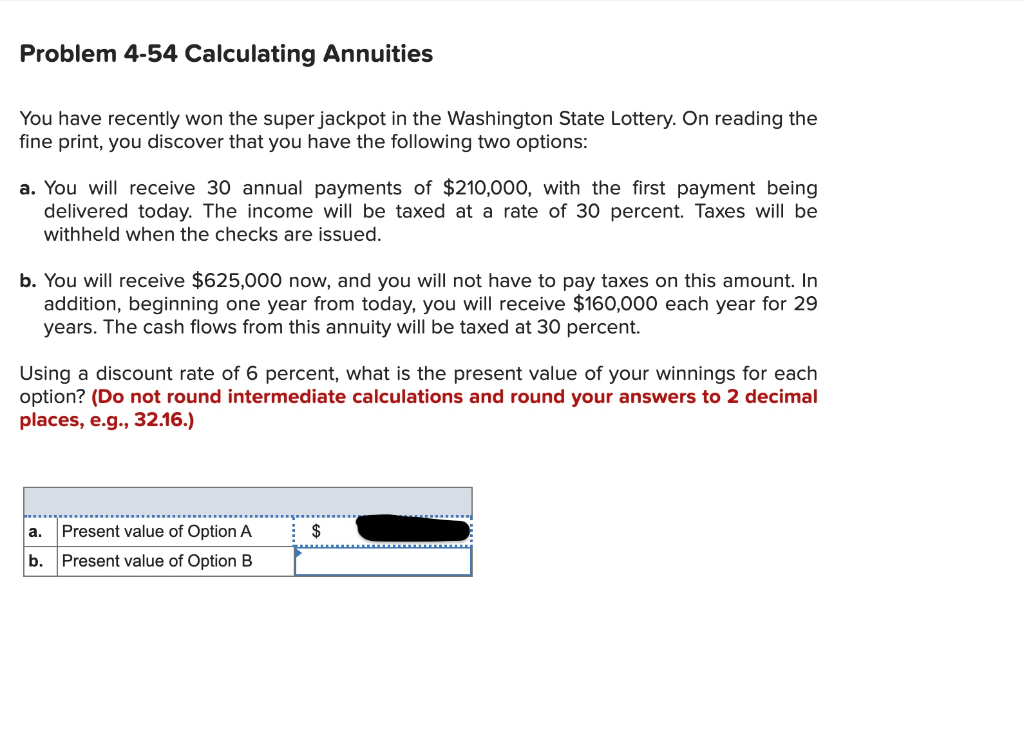

Problem 4-54 Calculating Annuities You have recently won the super jackpot in the Washington State Lottery. On reading the fine print, you discover that you have the following two options: a. You will receive 30 annual payments of $210,000, with the first payment being delivered today. The income will be taxed at a rate of 30 percent. Taxes will be withheld when the checks are issued. b. You will receive $625,000 now, and you will not have to pay taxes on this amount. In addition, beginning one year from today, you will receive $160,000 each year for 29 years. The cash flows from this annuity will be taxed at 30 percent. Using a discount rate of 6 percent, what is the present value of your winnings for each option? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present value of Option A $ a. Present value of Option B b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts