Question: Problem 4-5A (Algo) Preparing adjusting entries and income statements; computing gross margin, acid- test, and current ratios LO A1, P3, P4 (The following information applies

![information applies to the questions displayed below.] The following unadjusted trial balance](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1f67df1ed9_30966f1f67d89948.jpg)

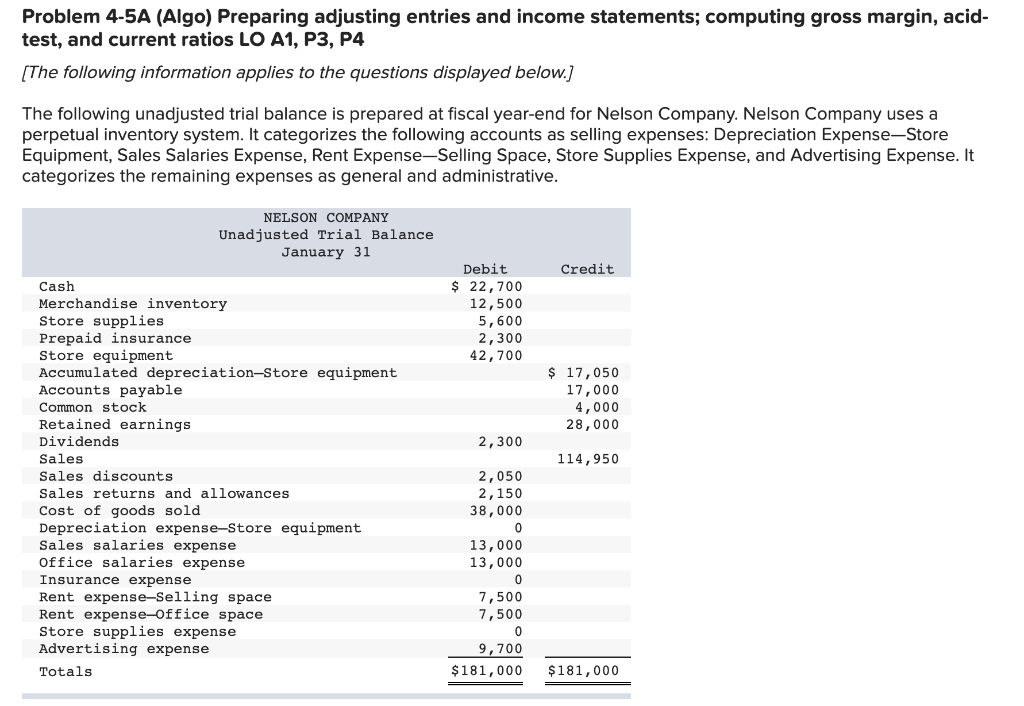

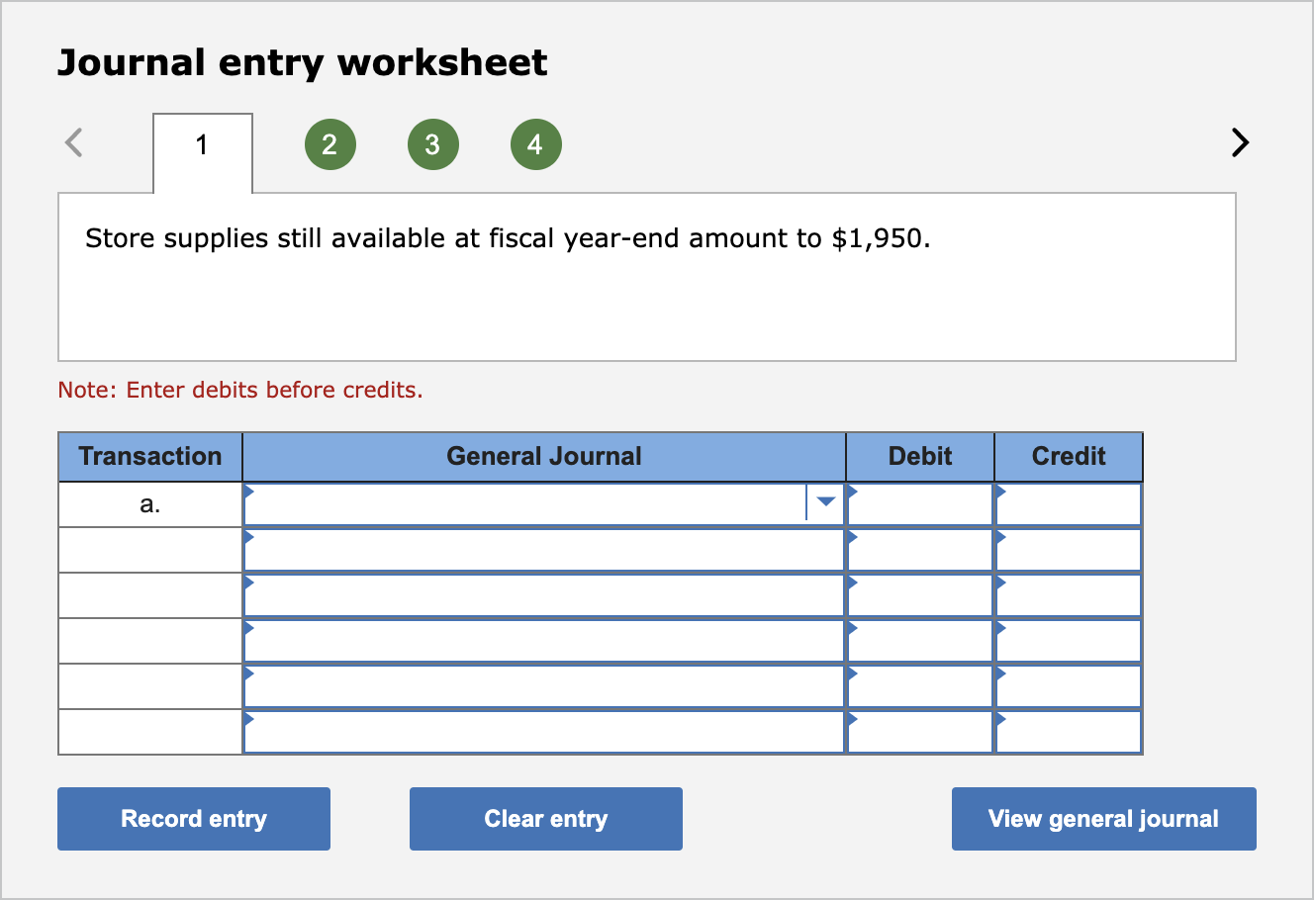

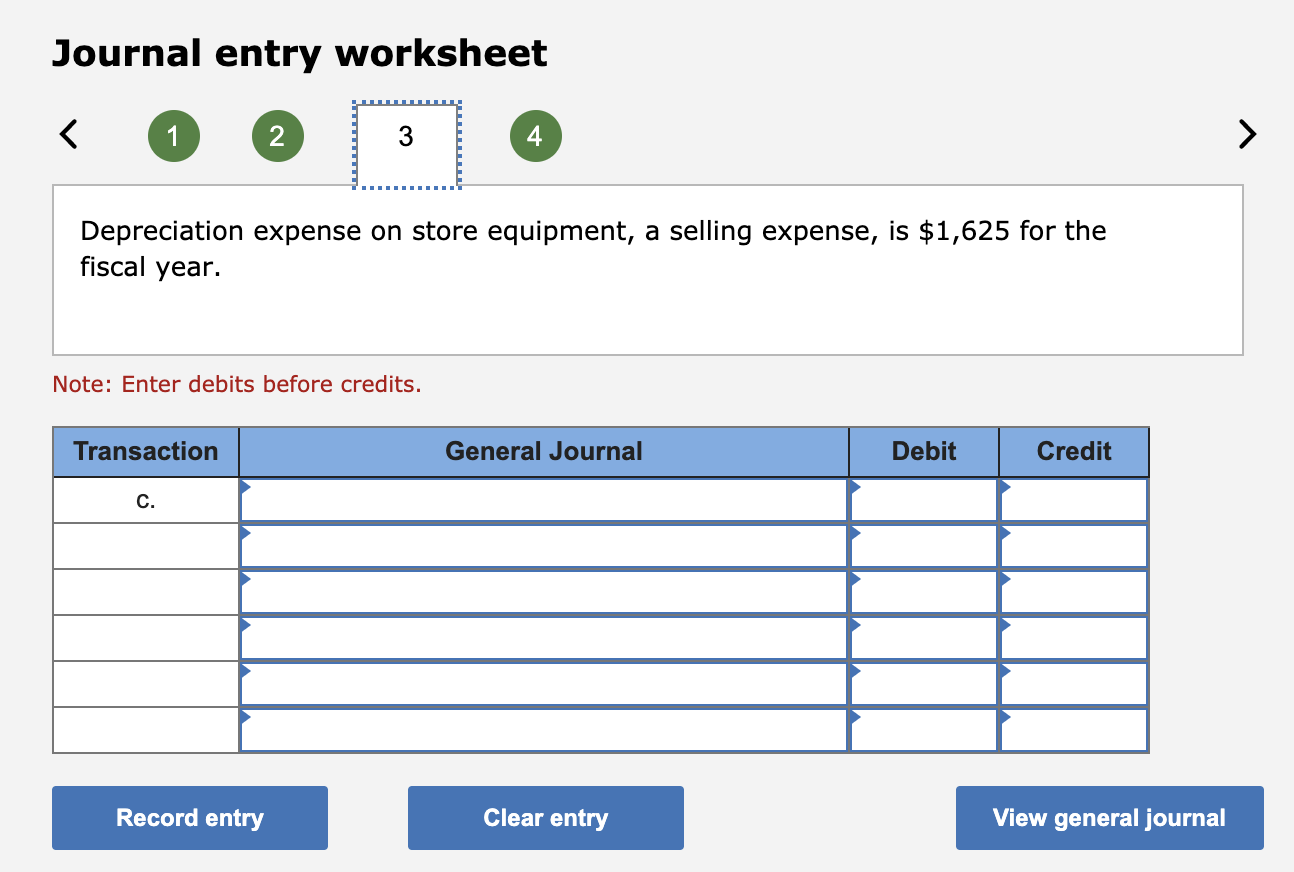

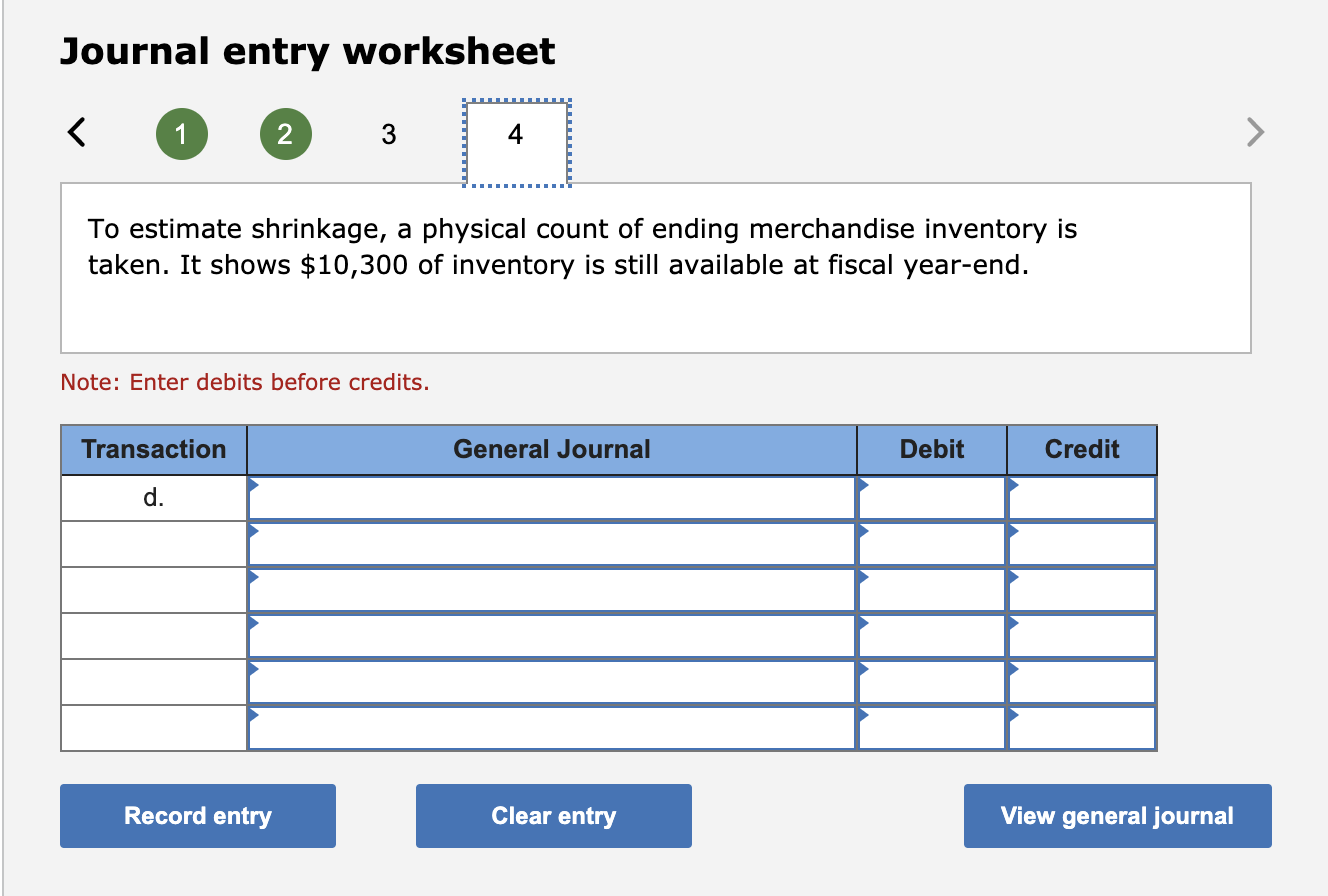

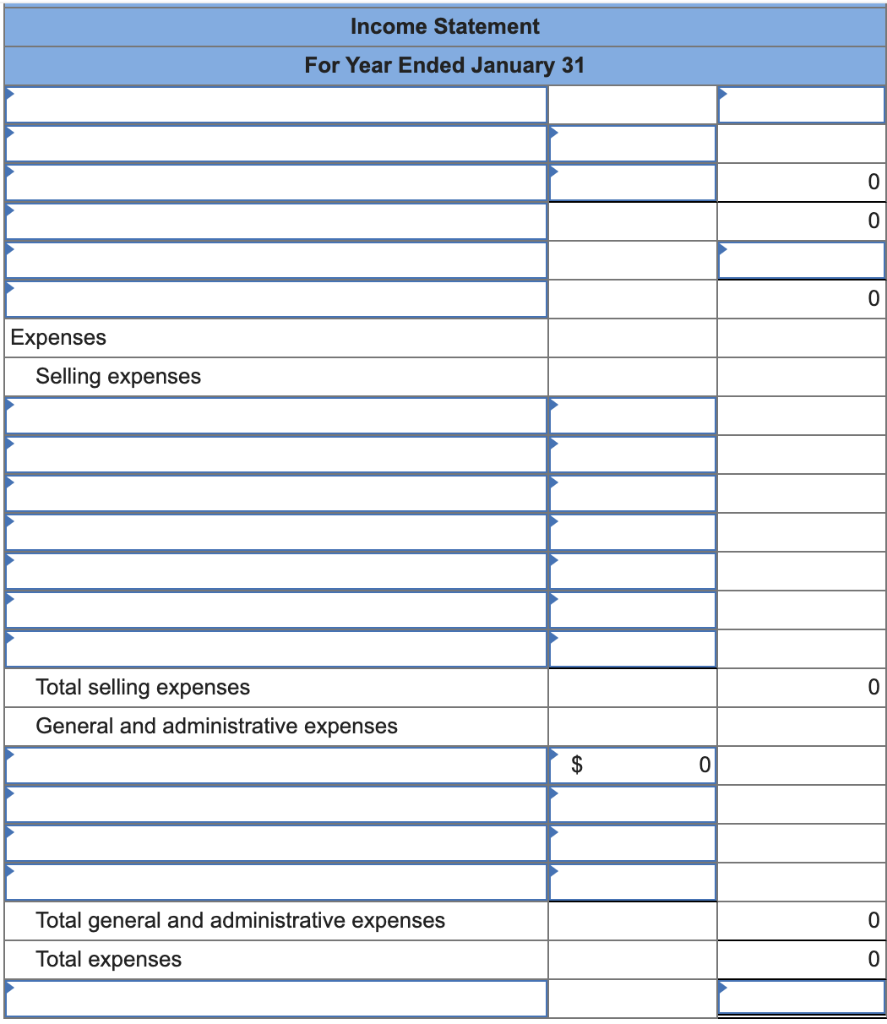

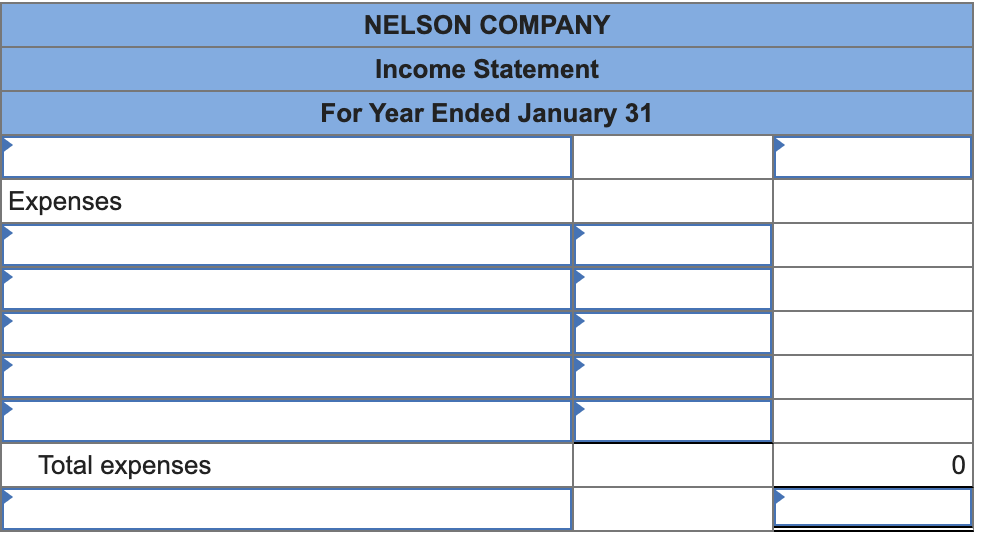

Problem 4-5A (Algo) Preparing adjusting entries and income statements; computing gross margin, acid- test, and current ratios LO A1, P3, P4 (The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. NELSON COMPANY Unadjusted Trial Balance January 31 Credit Debit $ 22,700 12,500 5,600 2,300 42,700 $ 17,050 17,000 4,000 28,000 2,300 114,950 Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated depreciation-Store equipment Accounts payable Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Sales salaries expense Office salaries expense Insurance expense Rent expense-Selling space Rent expense-Office space Store supplies expense Advertising expense Totals 2,050 2,150 38,000 13,000 13,000 0 7,500 7,500 0 9,700 $181,000 $181,000 Journal entry worksheet Expired insurance, an administrative expense, is $1,400 for the fiscal year. Note: Enter debits before credits. Transaction General Journal Debit Credit b. Record entry Clear entry View general journal Journal entry worksheet Depreciation expense on store equipment, a selling expense, is $1,625 for the fiscal year. Note: Enter debits before credits. Transaction General Journal Debit Credit C. Record entry Clear entry View general journal Journal entry worksheet To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,300 of inventory is still available at fiscal year-end. Note: Enter debits before credits. Transaction General Journal Debit Credit d. Record entry Clear entry View general journal Income Statement For Year Ended January 31 0 0 0 Expenses Selling expenses 0 Total selling expenses General and administrative expenses $ 0 Total general and administrative expenses 0 Total expenses 0 NELSON COMPANY Income Statement For Year Ended January 31 Expenses Total expenses 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts