Question: Problem 4-6 A 30-year fully amortizing mortgage loan was made 10 years ago for $75,000 at 6 percent interest. The borrower would like to prepay

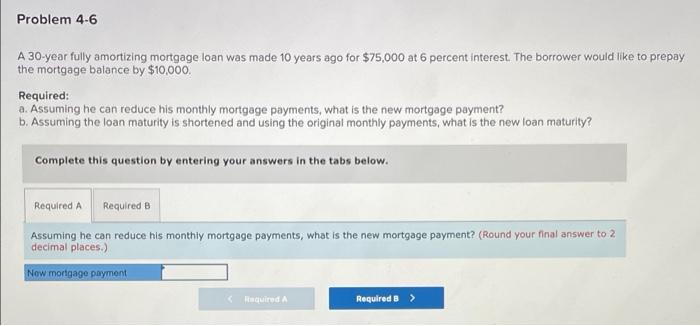

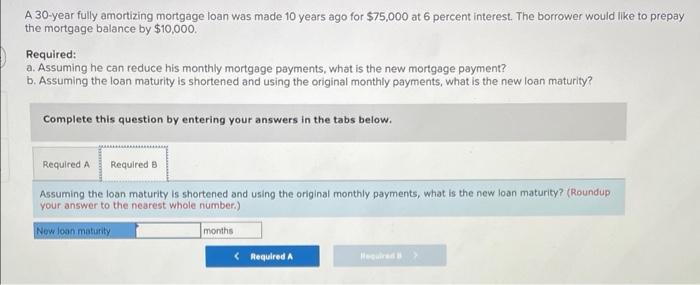

Problem 4-6 A 30-year fully amortizing mortgage loan was made 10 years ago for $75,000 at 6 percent interest. The borrower would like to prepay the mortgage balance by $10,000, Required: a. Assuming he can reduce his monthly mortgage payments, what is the new mortgage payment? b. Assuming the loan maturity is shortened and using the original monthly payments, what is the new loan maturity? Complete this question by entering your answers in the tabs below. Required A Required B Assuming he can reduce his monthly mortgage payments, what is the new mortgage payment? (Round your final answer to 2 decimal places.) Now mortgage payment Amquired Required B > A 30-year fully amortizing mortgage loan was made 10 years ago for $75,000 at 6 percent interest. The borrower would like to prepay the mortgage balance by $10,000. Required: a. Assuming he can reduce his monthly mortgage payments, what is the new mortgage payment? b. Assuming the loan maturity is shortened and using the original monthly payments, what is the new loan maturity? Complete this question by entering your answers in the tabs below. Required A Required B Assuming the loan maturity is shortened and using the original monthly payments, what is the new loan maturity? (Roundup your answer to the nearest whole number.) New lon muturity months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts