Question: Problem 4-6 Larime Corp. is forecasting 20X2 near the end of 20X1. The estimated year-end financial statements and a worksheet for the forecast are given

Problem 4-6

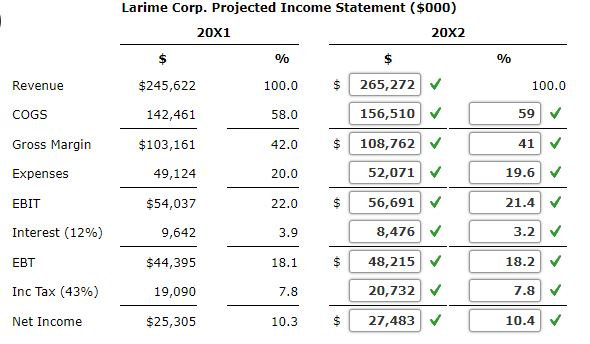

Larime Corp. is forecasting 20X2 near the end of 20X1. The estimated year-end financial statements and a worksheet for the forecast are given below.

Management expects the following next year.

An 8% increase in revenue.

Price cutting will cause the cost ratio (COGS/sales) to deteriorate (increase) by 1% (of sales) from its current level.

Expenses will increase at a rate that is three quarters of that of sales.

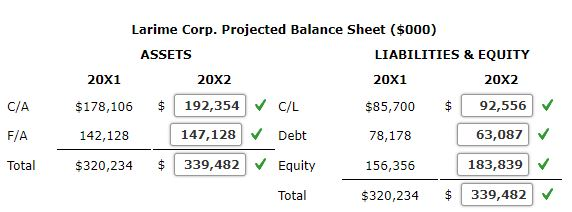

The current accounts will increase proportionately with sales.

Net fixed assets will increase by $5 million.

All interest will be paid at 12%.

Federal and state income taxes will be paid at a combined rate of 43%.

Make a forecast of Larime's complete income statement and balance sheet. Enter your dollar answers in thousands. For example, an answer of $12 thousands should be entered as 12, not 12,000. Round percentage values to 1 decimal place. Enter all amounts as a positive numbers.

All answers are correct, but I'm not sure how they are obtained. Please show work

Larime Corp. Projected Income Statement ($000) 20X1 20X2 $245,622 142,461 $103,161 49,124 $54,037 9,642 $44,395 19,090 $25,305 100.0265,272 Revenue COGS Gross Margin Expenses EBIT Interest (12%) EBT Inc Tax (43%) Net Income 100.0 156,510 58.0 42.0 108,762 20.0 22.0 56,691 59 52,071 19.6 21.4 8,476 V 18.1 $148,215| 18.2 7.8 20,732 10.3 27,483v 10.4 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts