Question: (Problem 4.6) You are making an audit for the year ended December 31, 2005, of the financial statements of Kosti-Marian Company, which carries on

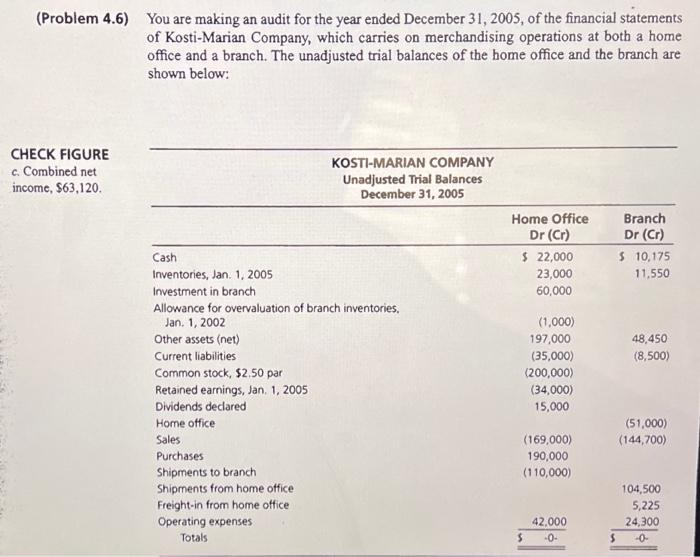

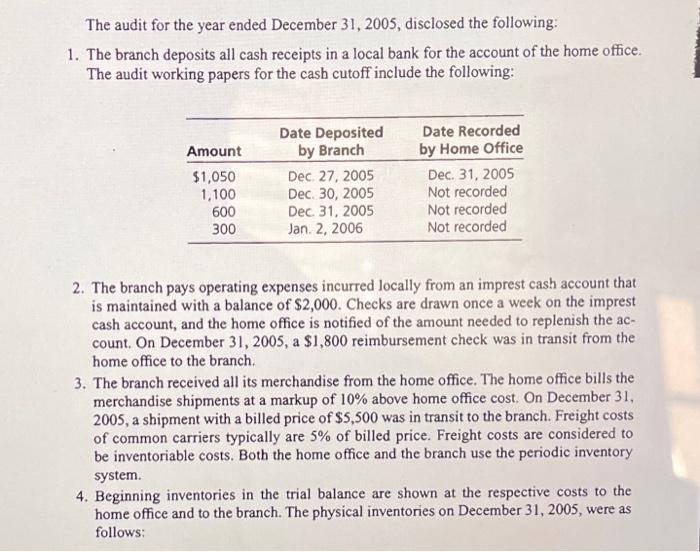

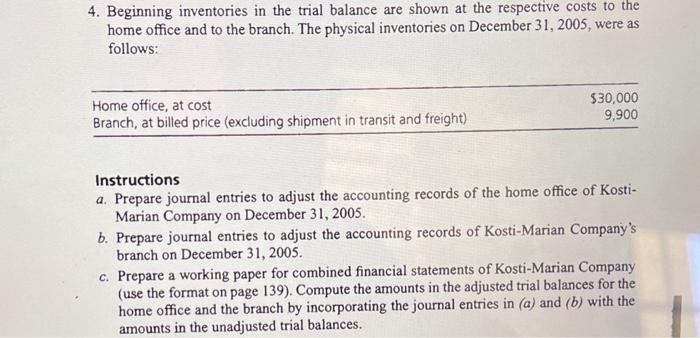

(Problem 4.6) You are making an audit for the year ended December 31, 2005, of the financial statements of Kosti-Marian Company, which carries on merchandising operations at both a home office and a branch. The unadjusted trial balances of the home office and the branch are shown below: CHECK FIGURE c. Combined net income, $63,120. Cash Inventories, Jan. 1, 2005 Investment in branch Allowance for overvaluation of branch inventories. Jan. 1, 2002 Other assets (net) Current liabilities Common stock, $2.50 par Retained earnings, Jan. 1, 2005 Dividends declared Home office Sales KOSTI-MARIAN COMPANY Unadjusted Trial Balances December 31, 2005 Purchases Shipments to branch Shipments from home office. Freight-in from home office Operating expenses Totals Home Office: Dr (Cr) $ 22,000 23,000 60,000 (1,000) 197,000 (35,000) (200,000) (34,000) 15,000 (169,000) 190,000 (110,000) S 42,000 -0- S Branch Dr (Cr) $ 10,175 11,550 48,450 (8,500) (51,000) (144,700) 104,500 5,225 24,300 -0- The audit for the year ended December 31, 2005, disclosed the following: 1. The branch deposits all cash receipts in a local bank for the account of the home office. The audit working papers for the cash cutoff include the following: Amount $1,050 1,100 600 300 Date Deposited by Branch Dec 27, 2005 Dec. 30, 2005 Dec. 31, 2005 Jan. 2, 2006 Date Recorded by Home Office Dec. 31, 2005 Not recorded Not recorded Not recorded 2. The branch pays operating expenses incurred locally from an imprest cash account that is maintained with a balance of $2,000. Checks are drawn once a week on the imprest cash account, and the home office is notified of the amount needed to replenish the ac- count. On December 31, 2005, a $1,800 reimbursement check was in transit from the home office to the branch. 3. The branch received all its merchandise from the home office. The home office bills the merchandise shipments at a markup of 10% above home office cost. On December 31, 2005, a shipment with a billed price of $5,500 was in transit to the branch. Freight costs of common carriers typically are 5% of billed price. Freight costs are considered to be inventoriable costs. Both the home office and the branch use the periodic inventory system. 4. Beginning inventories in the trial balance are shown at the respective costs to the home office and to the branch. The physical inventories on December 31, 2005, were as follows: 4. Beginning inventories in the trial balance are shown at the respective costs to the home office and to the branch. The physical inventories on December 31, 2005, were as follows: Home office, at cost Branch, at billed price (excluding shipment in transit and freight) $30,000 9,900 Instructions a. Prepare journal entries to adjust the accounting records of the home office of Kosti- Marian Company on December 31, 2005. b. Prepare journal entries to adjust the accounting records of Kosti-Marian Company's branch on December 31, 2005. c. Prepare a working paper for combined financial statements of Kosti-Marian Company (use the format on page 139). Compute the amounts in the adjusted trial balances for the home office and the branch by incorporating the journal entries in (a) and (b) with the amounts in the unadjusted trial balances.

Step by Step Solution

There are 3 Steps involved in it

You have provided information from an audit for the year ended December 31 2005 for KostiMarian Company which operates both a home office and a branch The unadjusted trial balances for both are given ... View full answer

Get step-by-step solutions from verified subject matter experts