Question: Problem 4-7 Your answer is partially correct. Try again Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2011,

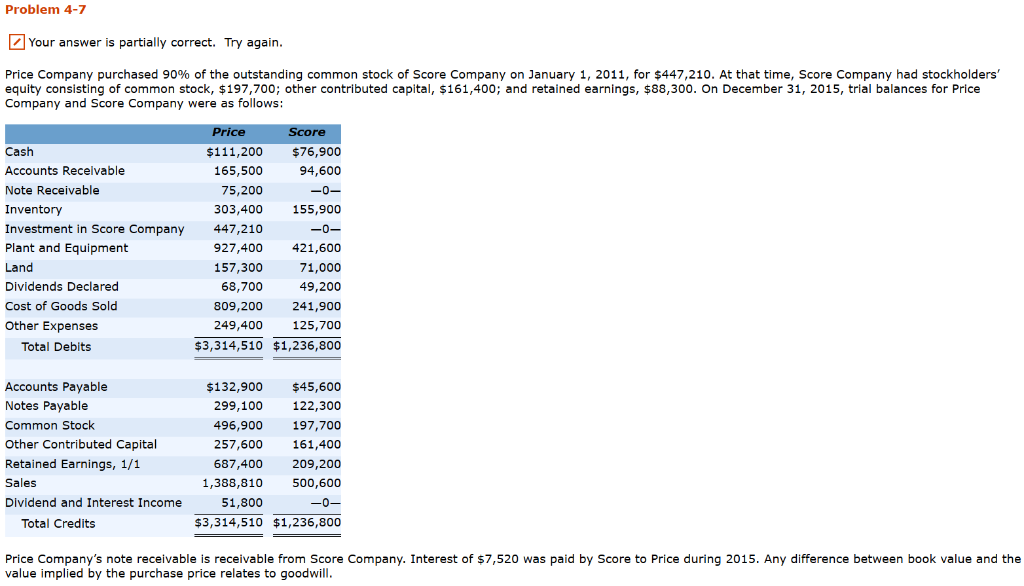

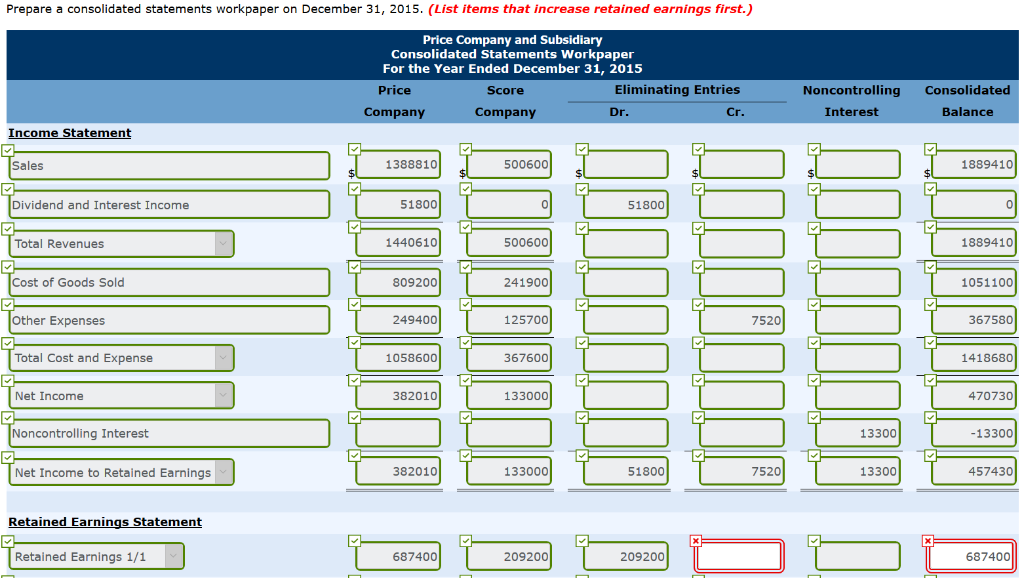

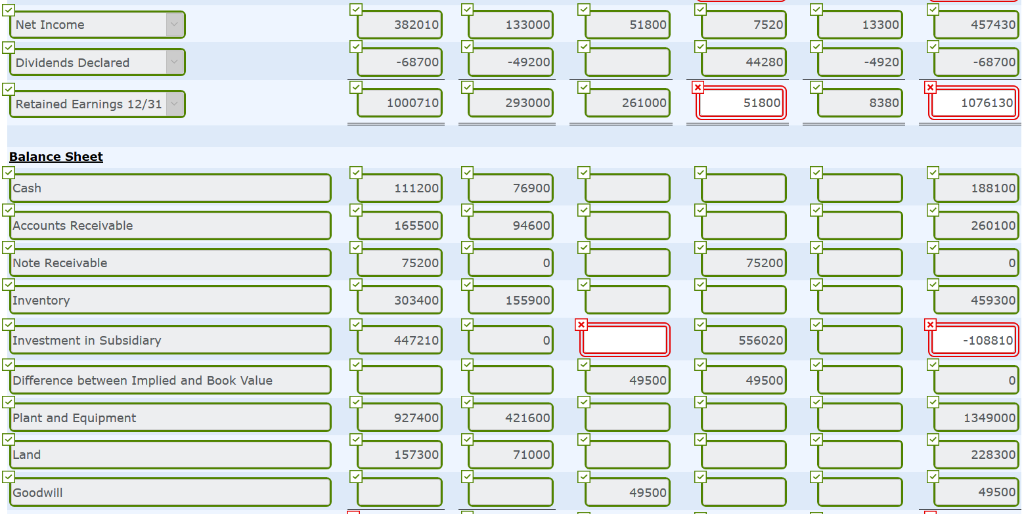

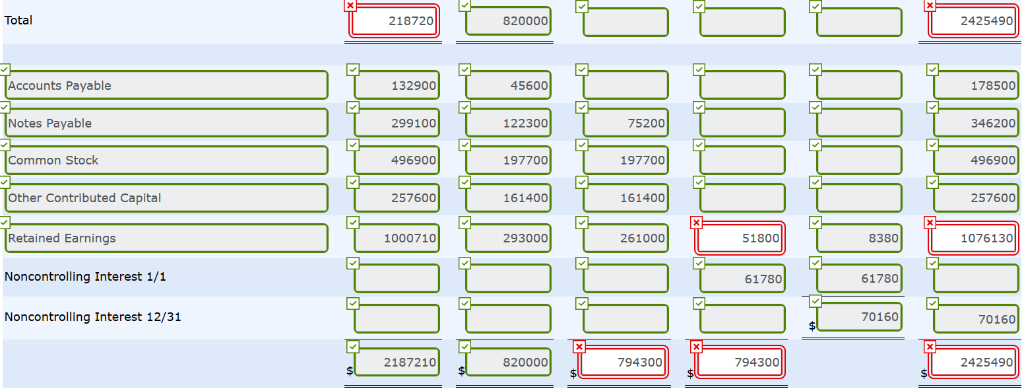

Problem 4-7 Your answer is partially correct. Try again Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2011, for $447,210. At that time, Score Company had stockholders equity consisting of common stock, $197,700; other contributed capital, $161,400; and retained earnings, $88,300. On December 31, 2015, trial balances for Price Company and Score Company were as follows: Score Cash Accounts Recelvable Note Receivable Inventory Investment in Score Company Plant and Equipment Land Dividends Declared Cost of Goods Sold Other Expenses $111,200 $76,900 94,600 165,500 75,200 303,400 447,210 927,400 157,300 0 155,900 421,600 71,000 68,700 49,200 809,200 241,900 249,400 125,700 $3,314,510 $1,236,800 Total Debits Accounts Payable Notes Payable Common Stock Other Contributed Capital Retained Earnings, 1/1 Sales Dividend and Interest Income $132,900 $45,600 299,100 122,300 496,900 197,700 257,600 161,400 687,400 209,200 1,388,810 500,600 51,800 Total Credits $3,314,510 $1,236,800 Price Company's note receivable is receivable from Score Company. Interest of $7,520 was paid by Score to Price during 2015. Any difference between book value and the value implied by the purchase price relates to goodwill Prepare a consolidated statements workpaper on December 31, 2015. (List items that increase retained earnings first.) Price Company and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2015 Price Score Eliminating Entries Noncontrolling Consolidated Company Company Dr Cr. Interest Balance Income Statement Sales 1388810 500600 1889410 Dividend and Interest Income 51800 0 51800 Total Revenues 1440610 500600 1889410 Cost of Goods Sold 809200 241900 1051100 Other Expenses 249400 125700 7520 367580 Total Cost and Expense 1058600 367600 1418680 Net Income 382010 133000 470730 Noncontrolling Interest 13300 -13300 38201013300080075215300 4574,30 Net Income to Retained Earnings 51800 Retained Earnings Statement 65740 00 209200 Retained Earnings 1/1 687400 687400 Net Income 382010 133000 51800 7520 13300 457430 Dividends Declared 68700 -49200 44280 -4920 -68700 Retained Earnings 12/31 1000710 293000 261000 51800 8380 1076130 Cash 111200 76900 188100 Accounts Receivable 165500 94600 260100 Note Receivable 75200 0 75200 Inventory 303400 155900 459300 447210 Investment in Subsidiary Difference between Implied and Book Value Plant and Equipment 556020 -108810 49500 49500 927400 421600 1349000 Land 157300 71000 228300 Goodwill 49500 49500 Total 218720 820000 2425490 Accounts Payable 132900 45600 178500 Notes Payable 299100 122300 75200 346200 Common Stock 496900 197700 197700 496900 Other Contributed Capital Retained Earnings Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 257600 161400 161400 257600 1000710 293000 261000 51800 8380 1076130 61780 61780 70160 70160 2187210 820000 794300 794300 2425490 Problem 4-7 Your answer is partially correct. Try again Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2011, for $447,210. At that time, Score Company had stockholders equity consisting of common stock, $197,700; other contributed capital, $161,400; and retained earnings, $88,300. On December 31, 2015, trial balances for Price Company and Score Company were as follows: Score Cash Accounts Recelvable Note Receivable Inventory Investment in Score Company Plant and Equipment Land Dividends Declared Cost of Goods Sold Other Expenses $111,200 $76,900 94,600 165,500 75,200 303,400 447,210 927,400 157,300 0 155,900 421,600 71,000 68,700 49,200 809,200 241,900 249,400 125,700 $3,314,510 $1,236,800 Total Debits Accounts Payable Notes Payable Common Stock Other Contributed Capital Retained Earnings, 1/1 Sales Dividend and Interest Income $132,900 $45,600 299,100 122,300 496,900 197,700 257,600 161,400 687,400 209,200 1,388,810 500,600 51,800 Total Credits $3,314,510 $1,236,800 Price Company's note receivable is receivable from Score Company. Interest of $7,520 was paid by Score to Price during 2015. Any difference between book value and the value implied by the purchase price relates to goodwill Prepare a consolidated statements workpaper on December 31, 2015. (List items that increase retained earnings first.) Price Company and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2015 Price Score Eliminating Entries Noncontrolling Consolidated Company Company Dr Cr. Interest Balance Income Statement Sales 1388810 500600 1889410 Dividend and Interest Income 51800 0 51800 Total Revenues 1440610 500600 1889410 Cost of Goods Sold 809200 241900 1051100 Other Expenses 249400 125700 7520 367580 Total Cost and Expense 1058600 367600 1418680 Net Income 382010 133000 470730 Noncontrolling Interest 13300 -13300 38201013300080075215300 4574,30 Net Income to Retained Earnings 51800 Retained Earnings Statement 65740 00 209200 Retained Earnings 1/1 687400 687400 Net Income 382010 133000 51800 7520 13300 457430 Dividends Declared 68700 -49200 44280 -4920 -68700 Retained Earnings 12/31 1000710 293000 261000 51800 8380 1076130 Cash 111200 76900 188100 Accounts Receivable 165500 94600 260100 Note Receivable 75200 0 75200 Inventory 303400 155900 459300 447210 Investment in Subsidiary Difference between Implied and Book Value Plant and Equipment 556020 -108810 49500 49500 927400 421600 1349000 Land 157300 71000 228300 Goodwill 49500 49500 Total 218720 820000 2425490 Accounts Payable 132900 45600 178500 Notes Payable 299100 122300 75200 346200 Common Stock 496900 197700 197700 496900 Other Contributed Capital Retained Earnings Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 257600 161400 161400 257600 1000710 293000 261000 51800 8380 1076130 61780 61780 70160 70160 2187210 820000 794300 794300 2425490

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts