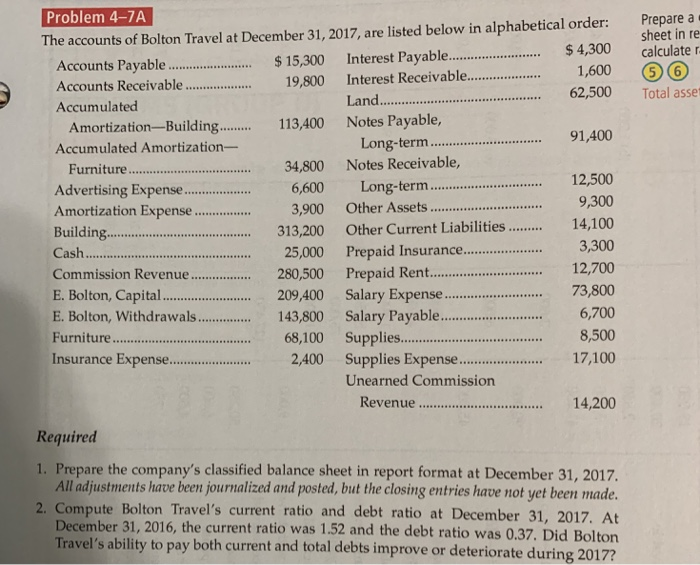

Question: Problem 4-7A Problem 4-7A Prepare a sheet in re The accounts of Bolton Travel at December 31, 2017, are listed below in alphabetical order: Accounts

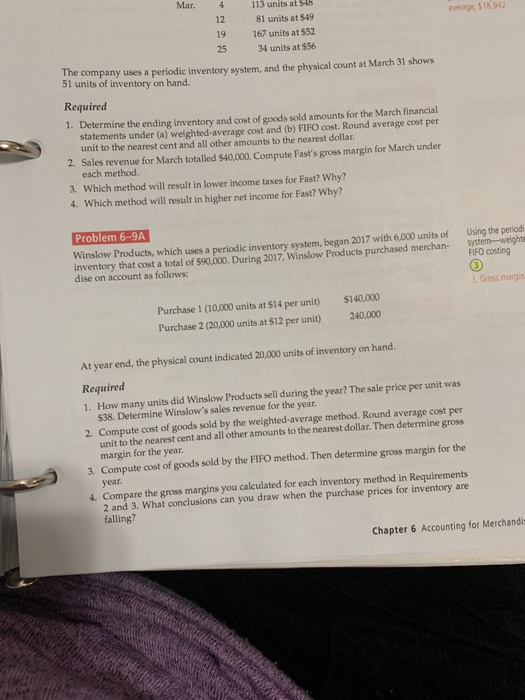

Problem 4-7A Prepare a sheet in re The accounts of Bolton Travel at December 31, 2017, are listed below in alphabetical order: Accounts Paytble.15,300 Interest Payable.4,300 1,600 6 Land. . 62,500 Total asse Accumulated Amortization-Building... 113,400 Notes Payable, Accumulated Amortization- Long-term...91,400 Furniture....34,800 Notes Receivable, Advertising Expense.. Amortization Expense.. Building Cas.25,000 Prepaid Insurance Commission Revenue..280,500 Prepaid Rent. E. Bolton, Capital.209,400 Salary Expens.. 6,600 Long-term.. 3,900 Other Assets .12,500 9,300 313,200 Other Current Liabilities..14,100 3,300 6,700 8,500 68,100 Supplies Insurance Expense. Unearned Commission Revenue 14,200 Required 1. Prepare the company's classified balance sheet in report format at December 31, 2017 All adjustments have been journalized and posted, but the closing entries have not yet been made. 2. Compute Bolton Travel's current ratio and debt ratio at December 31, 2017. At ratio was 0.37. Did Bolton December 31, 2016, the current ratio was 1.52 and the debt Travel's ability to pay both current and total debts improve or deteriorate dur Mar. 4 113 units at S46 12 81 units at $49 19 167 units at $52 25 34 units at $56 average $18942 The company uses a periodic inventory system, and the physical count at March 31 shows 51 units of inventory on hand. Required 1. Determine the ending inventory and cost of goods sold amounts for the March financial statements under (a) weighted-average cost and (b) FIFO cost. Round average cost per unit to the nearest cent and all other amounts to the nearest dollar 2. Sales revenue for March totalled $40,000. Compute Fast's gross margin for March under each method. 3. Which method will result in lower income taxes for Fast? Why? 4. Which method will result in higher net income for Fast? Why? Problem 6-9A Winslow Products, which uses a periodic inventory system, began 2017 with 6,000 units of inventory that cost a total of $90,000 During 2017, Winslow Products purchased merchan Using FIFO costing dise on account as follows: . Gross margin Purchase 1 (10,000 units at s14 per unit) $140,000 Purchase 2 (20,000 units at $12 per unit) 240,000 At year end, the physical count indicated 20,000 units of inventory on hand Required 1. owmany uns did Winslonw Products el during the year? The sale rice per unit was 2. Compute cost of goods sold by the weighted-average method. Round a $38. Determine Winslow's sales revenue for the year average cost per unit to the nearest cent and all other amounts to the nearest dollar. Then determine gross margin for the year Compute cost of goods sold by the FIFO method. Then determine gross margin for the year 3. 4. Compare the gross margins you calculated for each inventory method in Requirements 2 and 3. What conclusions can you draw when the purchase prices for inventory are falling? Chapter 6 Accounting for Merchandi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts