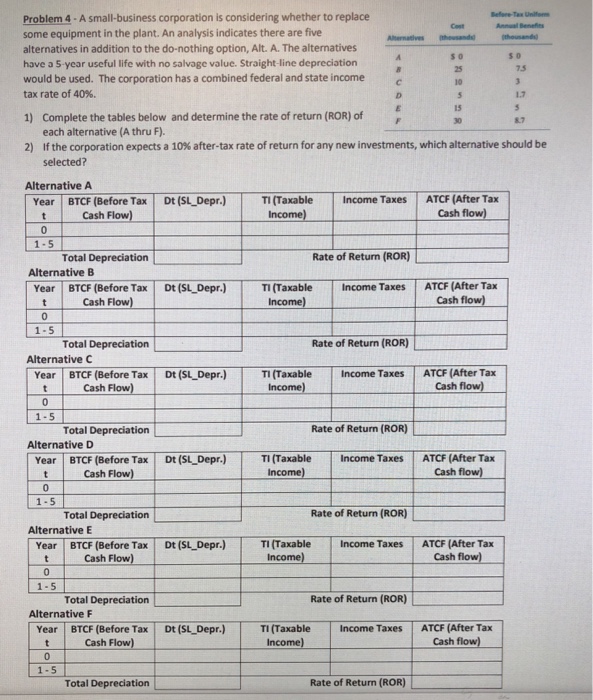

Question: Problem 4-A small-business corporation is considering whether to replace some equipment in the plant. An analysis indicates there are five alternatives in addition to the

Problem 4-A small-business corporation is considering whether to replace some equipment in the plant. An analysis indicates there are five alternatives in addition to the do-nothing option, Alt. A. The alternatives have a 5-year useful life with no salvage value. Straight-line depreciation would be used. The corporation has a combined federal and state income tax rate of 40%. ernatives thousands s 0 s 0 10 1.7 Complete the tables below and determine the rate of return (ROR) of each alternative (A thru F) If the corporation expects a 10% after-tax rate of return for any new investments, which alternative should be selected? 1) 2) Alternative A ATCF (After Tax Cash flow) | | | BTCF (Before Tax Cash Flow) Year | | Dt (SL-Depr.) TI (Taxable Income Taxes 0 Total Depreciation Rate of Return (ROR) Alternative B Year BTCF (Before Tax Dt (SL_Depr.) TI (Taxable Income Taxes ATCF (After Tax Cash t Cash Flow) 1-5 Total Depreciation Rate of Return (ROR) Alternative C Year BTCF (Before Tax Dt (SL_Depr.)T(axable Income Taxes tCash Flow) ATCF (After Tax Cash flow) 0 1-5 Total Depreciation Rate of Return (ROR) Alternative D Ti (Taxable Income) | Income Taxes | ATCF (After Tax Cash flow) Year BTCF (Before Tax Dt (SL Depr) Cash Flow) 1-5 Total Depreciation Rate of Return (ROR) Alternative E Year BTCF (Before Tax Dt (SL Depr.) TI (Taxable ncome Taxes ATCF (After Tax Cash Flow) Cash flow) 1- 5 Total Depreciation Rate of Return (ROR) Alternative F Year BTCF (Before Tax Dt (SL Depr.)TI(Taxable Income Taxes ATCF (After Tax Cash Flow Income) Cash flow) 0 Total Depreciation Rate of Return (ROR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts