Question: Problem 4.(Adapted C. Valix, J. Peralta, C. Valix 2017 page 1164) Jewelry Company had the following outstanding loans during 2017 and 2018. Specific construction loan

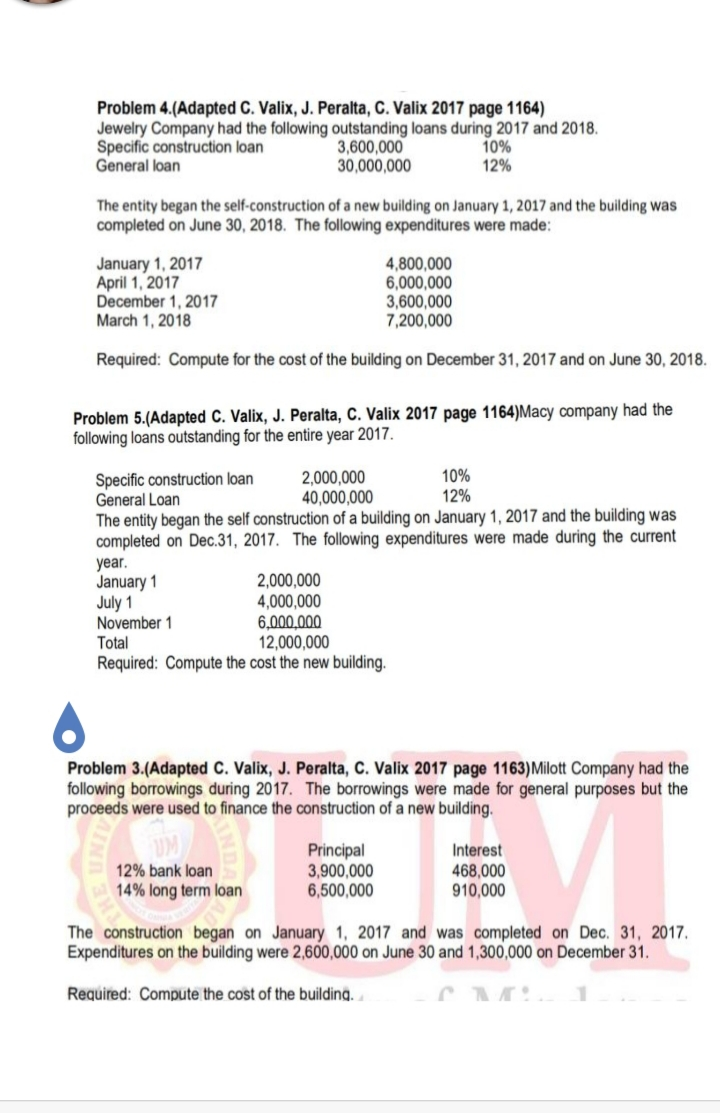

Problem 4.(Adapted C. Valix, J. Peralta, C. Valix 2017 page 1164) Jewelry Company had the following outstanding loans during 2017 and 2018. Specific construction loan 3,600,000 10% General loan 30,000,000 12% The entity began the self-construction of a new building on January 1, 2017 and the building was completed on June 30, 2018. The following expenditures were made: January 1, 2017 April 1, 2017 December 1, 2017 March 1, 2018 4,800,000 6,000,000 3,600,000 7,200,000 Required: Compute for the cost of the building on December 31, 2017 and on June 30, 2018. Problem 5.(Adapted C. Valix, J. Peralta, C. Valix 2017 page 1164)Macy company had the following loans outstanding for the entire year 2017 Specific construction loan 2,000,000 10% General Loan 40,000,000 12% The entity began the self construction of a building on January 1, 2017 and the building was completed on Dec.31, 2017. The following expenditures were made during the current year. January 1 2,000,000 July 1 4,000,000 November 1 6.000.000 Total 12,000,000 Required: Compute the cost the new building. Problem 3.(Adapted C. Valix, J. Peralta, C. Valix 2017 page 1163) Milott Company had the following borrowings during 2017. The borrowings were made for general purposes but the proceeds were used to finance the construction of a new building. 12% bank loan 14% long term loan Principal 3,900,000 6,500,000 Interest 468,000 910,000 The construction began on January 1, 2017 and was completed on Dec. 31, 2017 Expenditures on the building were 2,600,000 on June 30 and 1,300,000 on December 31. Required: Compute the cost of the building. Problem 4.(Adapted C. Valix, J. Peralta, C. Valix 2017 page 1164) Jewelry Company had the following outstanding loans during 2017 and 2018. Specific construction loan 3,600,000 10% General loan 30,000,000 12% The entity began the self-construction of a new building on January 1, 2017 and the building was completed on June 30, 2018. The following expenditures were made: January 1, 2017 April 1, 2017 December 1, 2017 March 1, 2018 4,800,000 6,000,000 3,600,000 7,200,000 Required: Compute for the cost of the building on December 31, 2017 and on June 30, 2018. Problem 5.(Adapted C. Valix, J. Peralta, C. Valix 2017 page 1164)Macy company had the following loans outstanding for the entire year 2017 Specific construction loan 2,000,000 10% General Loan 40,000,000 12% The entity began the self construction of a building on January 1, 2017 and the building was completed on Dec.31, 2017. The following expenditures were made during the current year. January 1 2,000,000 July 1 4,000,000 November 1 6.000.000 Total 12,000,000 Required: Compute the cost the new building. Problem 3.(Adapted C. Valix, J. Peralta, C. Valix 2017 page 1163) Milott Company had the following borrowings during 2017. The borrowings were made for general purposes but the proceeds were used to finance the construction of a new building. 12% bank loan 14% long term loan Principal 3,900,000 6,500,000 Interest 468,000 910,000 The construction began on January 1, 2017 and was completed on Dec. 31, 2017 Expenditures on the building were 2,600,000 on June 30 and 1,300,000 on December 31. Required: Compute the cost of the building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts