Question: Problem 5 - 1 0 Your firm is considering purchasing an old office building with an estimated remaining service life of 2 5 years. Recently,

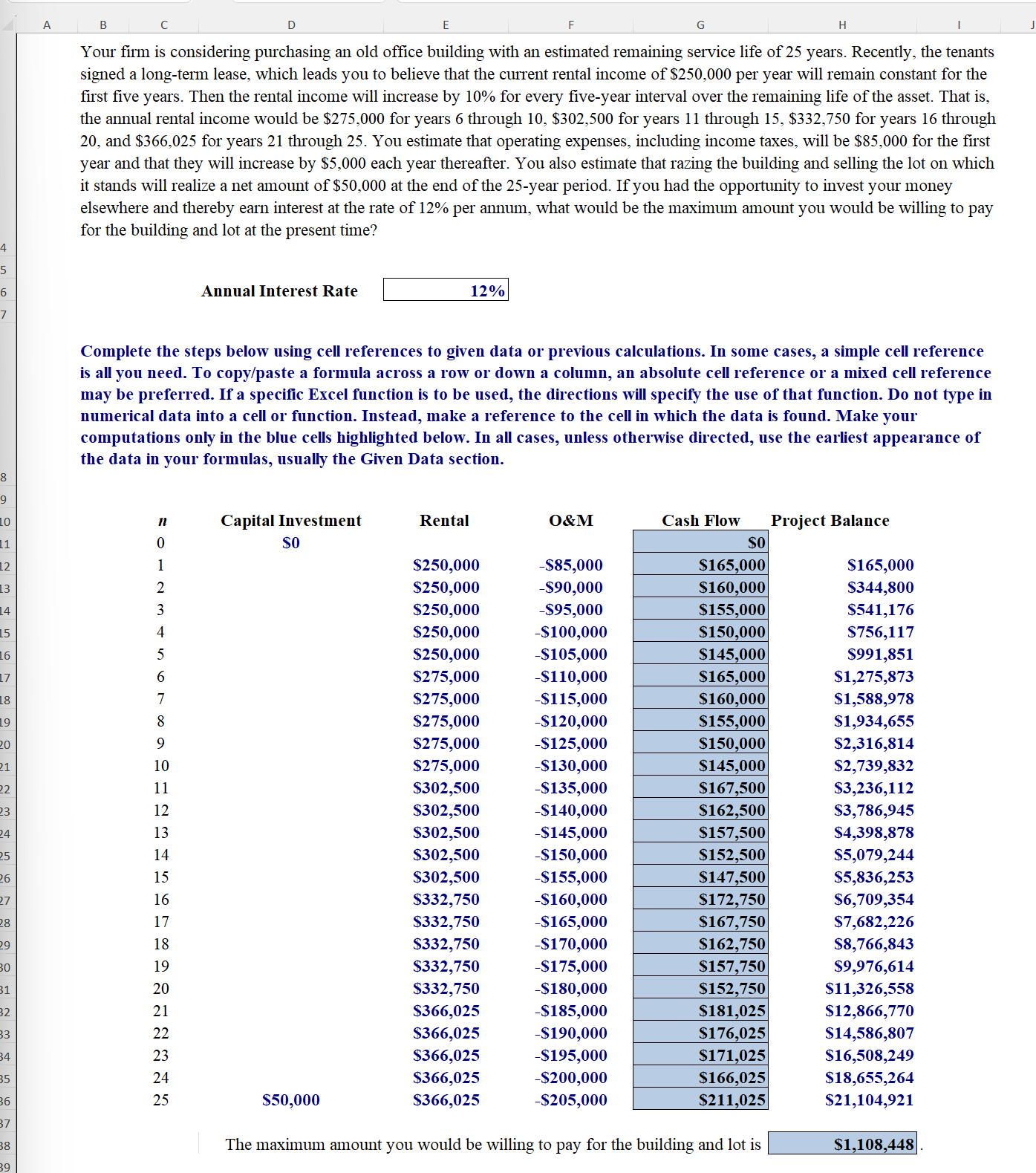

Problem Your firm is considering purchasing an old office building with an estimated remaining service life of years. Recently, the tenants signed a longterm lease, which leads you to believe that the current rental income of $ per year will remain constant for the first five years. Then the rental income will increase by for every fiveyear interval over the remaining life of the asset. That is the annual rental income would be $ for years through $ for years through $ for years through and $ for years through You estimate that operating expenses, including income taxes, will be $ for the first year and that they will increase by $ each year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $ at the end of the year period. If you had the opportunity to invest your money elsewhere and thereby earn interest at the rate of per annum, what would be the maximum amount you would be willing to pay for the building and lot at the present time? Annual Interest Rate Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copypaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. n Capital Investment Rental O&M Cash Flow Project Balance $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $$ $ $ $ $$ $ $ The maximum amount you would be willing to pay for the building and lot is $ Steps Start Excel completed. In cell G by using cell references, calculate the cash flow for year pt To calculate the cash flows for years through copy cell G and paste it onto cells G:G pt In cell H by using cell references and the function NPV calculate the maximum amount you would be willing to pay for the building and lot if the annual interest rate is pt Note: Use cell references to the cash flows from Steps and in your calculations. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed.

I used formulas:

cash flow: rentalO&M

Maximum amount you are will to pay: NPV$E$G:GG

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock