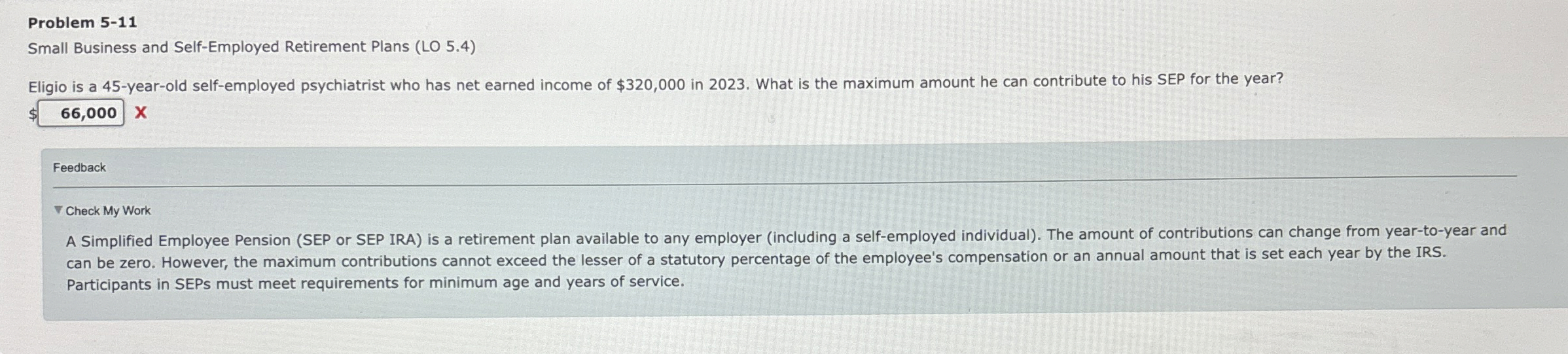

Question: Problem 5 - 1 1 Small Business and Self - Employed Retirement Plans ( LO 5 . 4 ) Eligio is a 4 5 -

Problem

Small Business and SelfEmployed Retirement Plans LO

Eligio is a yearold selfemployed psychiatrist who has net earned income of $ in What is the maximum amount he can contribute to his SEP for the year?

$

Feedback

VCheck My Work

A Simplified Employee Pension SEP or SEP IRA is a retirement plan available to any employer including a selfemployed individual The amount of contributions can change from yeartoyear and can be zero. However, the maximum contributions cannot exceed the lesser of a statutory percentage of the employee's compensation or an annual amount that is set each year by the IRS.

Participants in SEPs must meet requirements for minimum age and years of service.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock