Question: Problem 5 ( 1 2 points ) Coupon C o . is a deal - of - the - day company that is considering going

Problem points

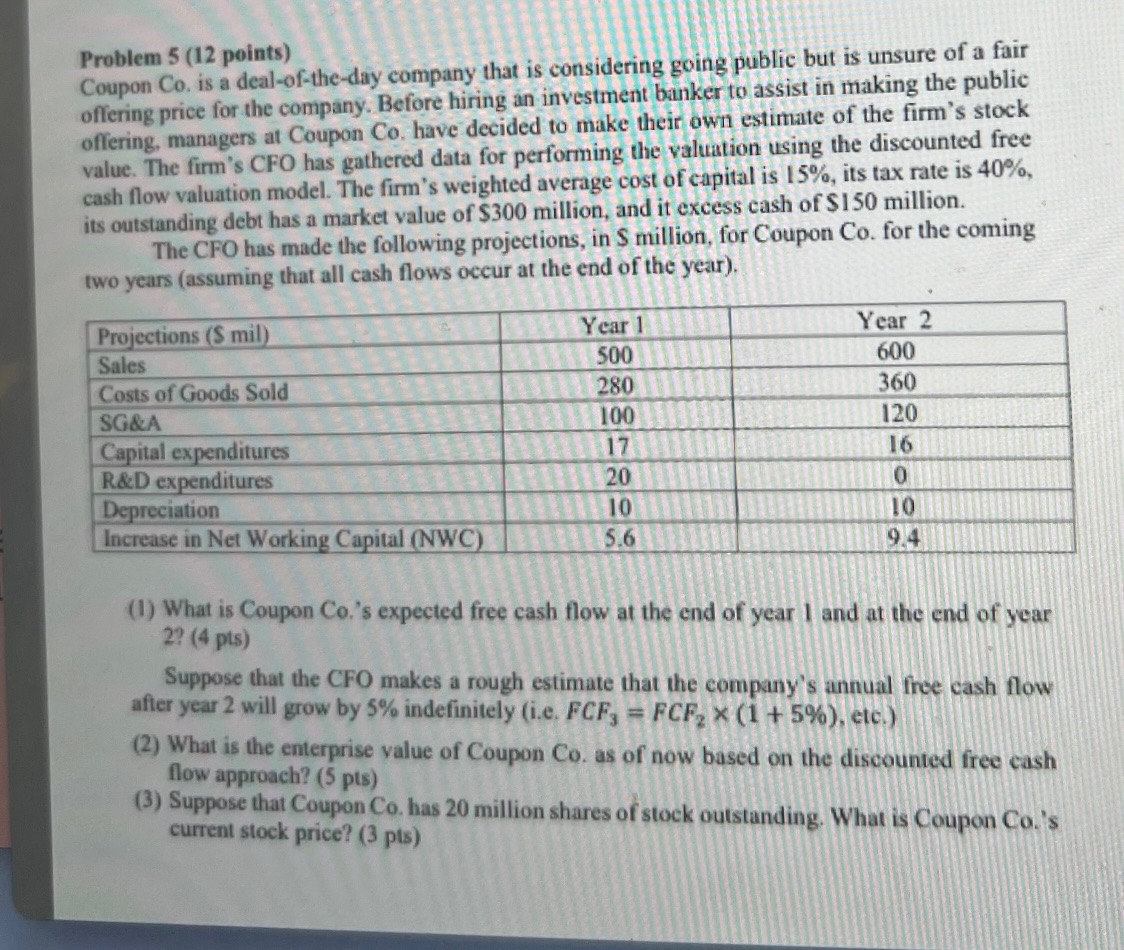

Coupon is a dealoftheday company that is considering going public but is unsure of a fair

offering price for the company. Before hiring an investment banker to assist in making the public

offering, managers at Coupon have decided to make their own estimate of the firm's stock

value. The firm's CFO has gathered data for performing the valuation using the discounted free

cash flow valuation model. The firm's weighted average cost of capital is its tax rate is

its outstanding debt has a market value of $ million, and it excess cash of $ million.

The CFO has made the following projections, in $ million, for Coupon for the coming

two years assuming that all cash flows occur at the end of the year

What is Coupon Cos expected free cash flow at the end of year and at the end of year

pts

Suppose that the CFO makes a rough estimate that the company's annual free cash flow

after year will grow by indefinitely ie etc.

What is the enterprise value of Coupon as of now based on the discounted free cash

flow approach? pts

Suppose that Coupon Co has million shares of stock outstanding. What is Coupon Co's

current stock price? pts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock