Question: problem 5 - 1 7 ( O 2 . 3 . 4 On fuly 1 . Year 4 . Aaron Co . purchased 8 0

problem

O

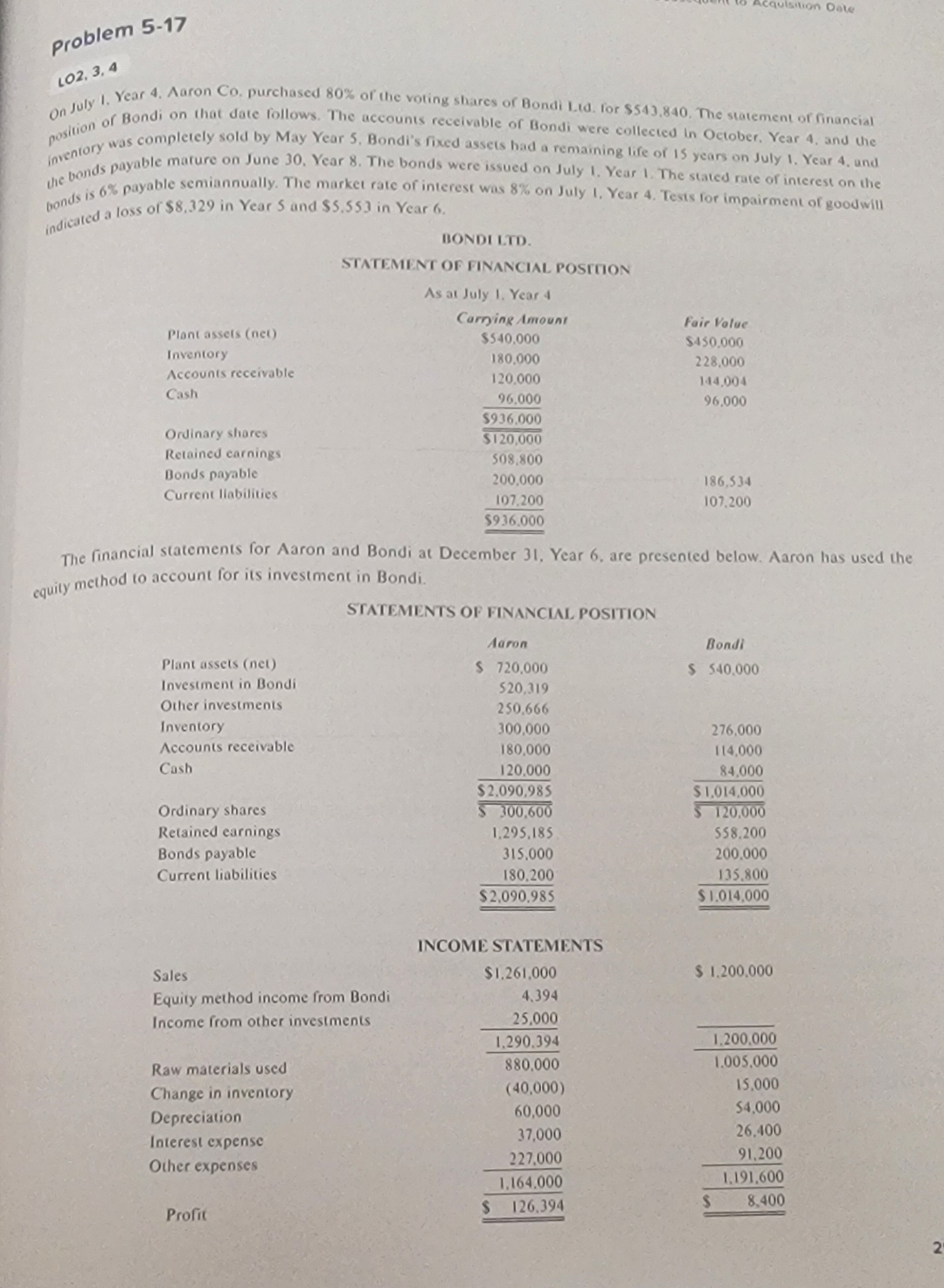

On fuly Year Aaron Co purchased of the voting shares of Bondi Lid. For $ The statement of financial posstion of Bondi on that date follows. The accounts receivable of Bondi were collected in October. Year and the invention was completely sold by May Year Bondi's fixed assets had a remaining life of years on July Year and die bends payable mature on June Year The bonds were issued on July Year The stated rate of interest on the bonds is payable semiannualty. The market rate of interest was on July Year Terts for impairment of goodwill indicaled a loss of $ in Year $ and $ in Year

BONDI LTD

STATEMENT OF FINANCIAL POSTHON

As at July I. Year

tableCarning Amount,Fair ValuePlontassets net$$InventoryAccounts receivable,Cash$Ordinary shares,$Retained carnings,Bonds payable,Current liabilities,$

The financial statements for Aaron and Bondi at December Year are presented below. Aaron has used the equily method to account for its investment in Bondi.

STATEMENTS OF FINANCIAL POSITION

tableAaron,BondiPlant assets netS s Investment in Bondi,Other investments,InventoryAccounts receivable,Cash$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock