Question: Problem # 5 ( 1 9 marks ) Pari Inc., an all - equity firm, has earnings before interest and taxes of $ 9 5

Problem # marks

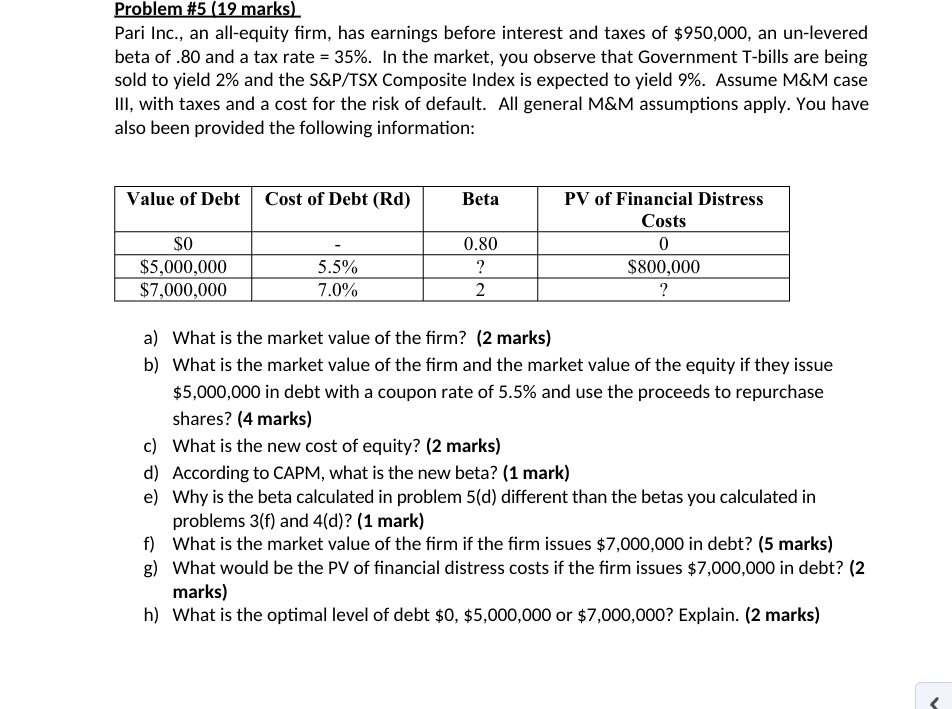

Pari Inc., an allequity firm, has earnings before interest and taxes of $ an unlevered

beta of and a tax rate In the market, you observe that Government Tbills are being

sold to yield and the S&PTSX Composite Index is expected to yield Assume M&M case

III, with taxes and a cost for the risk of default. All general M&M assumptions apply. You have

also been provided the following information:

a What is the market value of the firm? marks

b What is the market value of the firm and the market value of the equity if they issue

$ in debt with a coupon rate of and use the proceeds to repurchase

shares? marks

c What is the new cost of equity? marks

d According to CAPM, what is the new beta? mark

e Why is the beta calculated in problem d different than the betas you calculated in

problems f and d mark

f What is the market value of the firm if the firm issues $ in debt? marks

g What would be the PV of financial distress costs if the firm issues $ in debt?

marks

h What is the optimal level of debt $$ or $ Explain. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock