Question: Problem 5 (10 points) Date Purchases 07-Jan 25 units @ $7,500 each 15-Mar 35 units @ $8,000 each 16-Jun 15 units @ $8,250 each 03-Aug

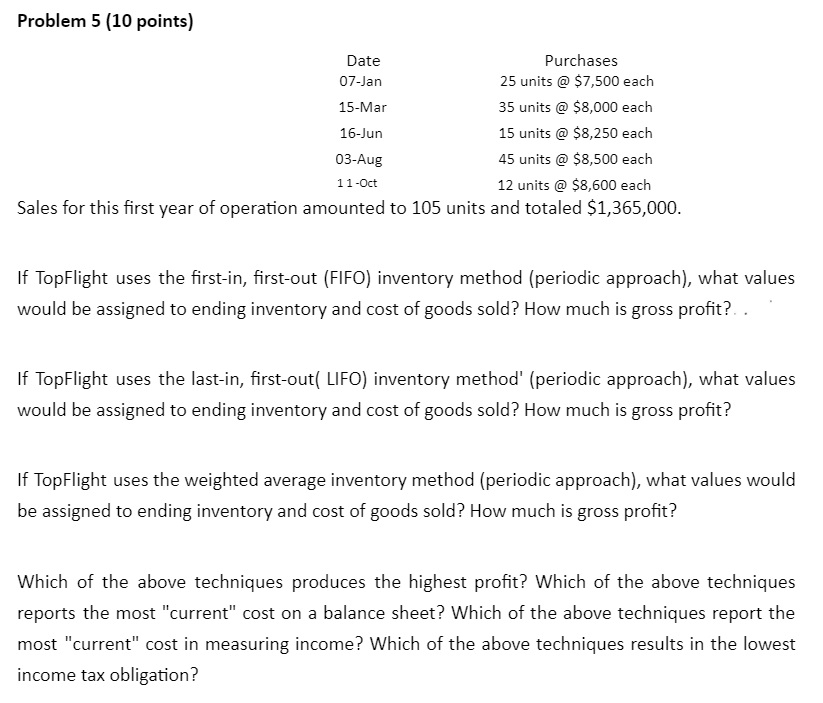

Problem 5 (10 points) Date Purchases 07-Jan 25 units @ $7,500 each 15-Mar 35 units @ $8,000 each 16-Jun 15 units @ $8,250 each 03-Aug 45 units @ $8,500 each 11-Oct 12 units @ $8,600 each Sales for this first year of operation amounted to 105 units and totaled $1,365,000. If TopFlight uses the first-in, first-out (FIFO) inventory method (periodic approach), what values would be assigned to ending inventory and cost of goods sold? How much is gross profit? If TopFlight uses the last-in, first-out( LIFO) inventory method' (periodic approach), what values would be assigned to ending inventory and cost of goods sold? How much is gross profit? If Top Flight uses the weighted average inventory method (periodic approach), what values would be assigned to ending inventory and cost of goods sold? How much is gross profit? Which of the above techniques produces the highest profit? Which of the above techniques reports the most "current" cost on a balance sheet? Which of the above techniques report the most "current" cost in measuring income? Which of the above techniques results in the lowest income tax obligation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts