Question: Problem 5 (10 points: Each question is worth 2 points) Provide brief answers to the following questions A. Explain how an increase in interest rates

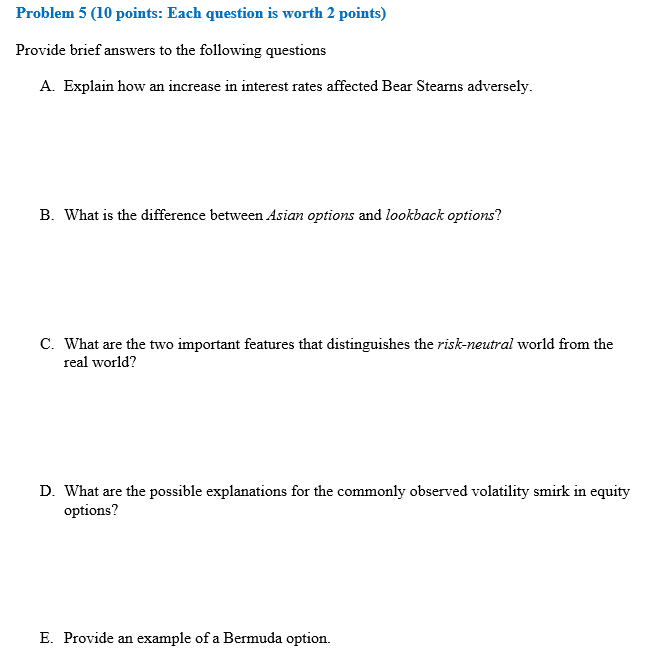

Problem 5 (10 points: Each question is worth 2 points) Provide brief answers to the following questions A. Explain how an increase in interest rates affected Bear Stearns adversely. B. What is the difference between Asian options and lookback options? C. What are the two important features that distinguishes the risk-neutral world from the real world? D. What are the possible explanations for the commonly observed volatility smirk in equity options? E. Provide an example of a Bermuda option. Problem 5 (10 points: Each question is worth 2 points) Provide brief answers to the following questions A. Explain how an increase in interest rates affected Bear Stearns adversely. B. What is the difference between Asian options and lookback options? C. What are the two important features that distinguishes the risk-neutral world from the real world? D. What are the possible explanations for the commonly observed volatility smirk in equity options? E. Provide an example of a Bermuda option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts