Question: Problem 5. (12 points) A certain portfolio II consists only of shares of stocks X and Y. The following information is known: The monthly expected

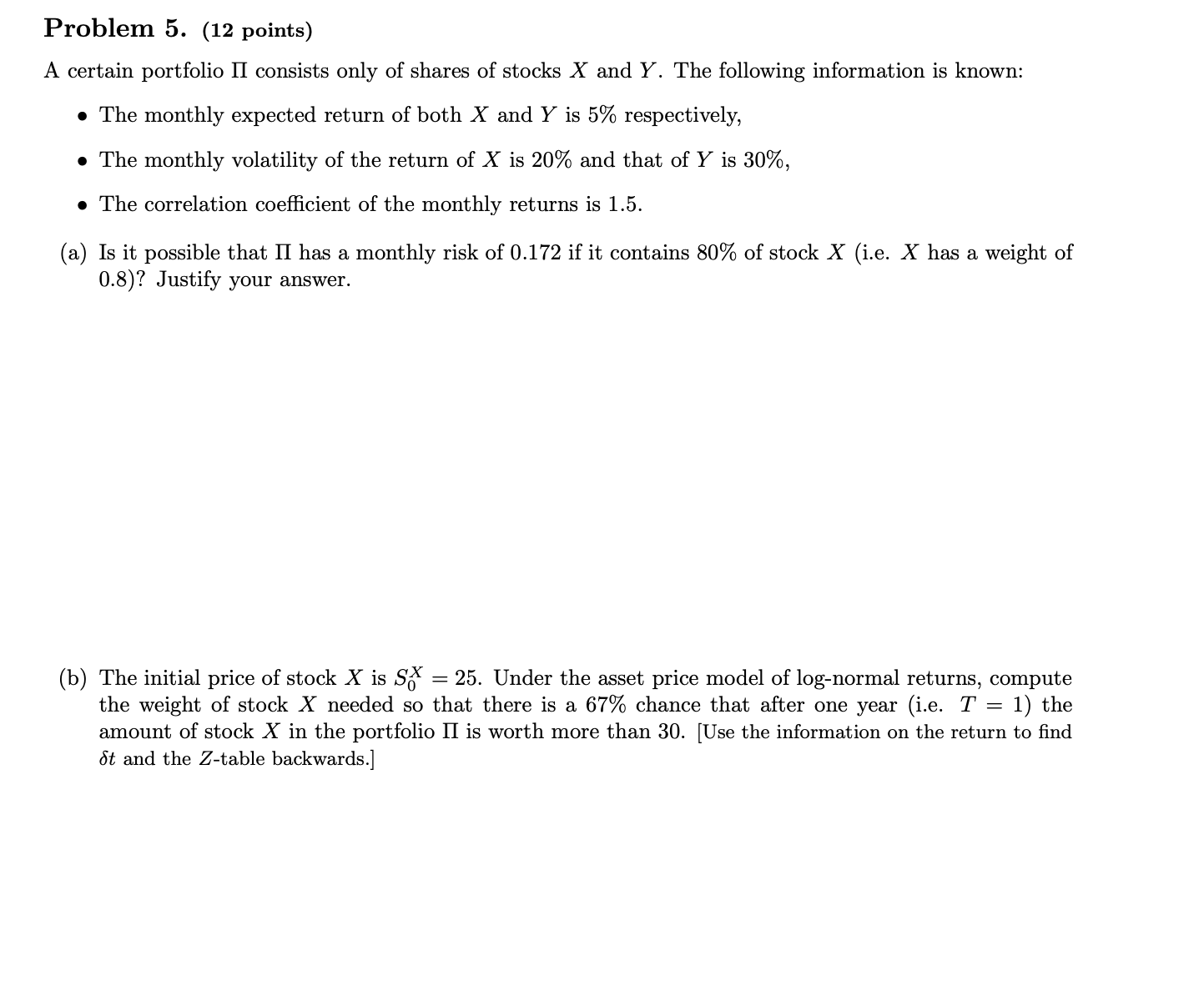

Problem 5. (12 points) A certain portfolio II consists only of shares of stocks X and Y. The following information is known: The monthly expected return of both X and Y is 5% respectively, The monthly volatility of the return of X is 20% and that of Y is 30%, The correlation coefficient of the monthly returns is 1.5. (a) Is it possible that II has a monthly risk of 0.172 if it contains 80% of stock X (i.e. X has a weight of 0.8)? Justify your answer. (b) The initial price of stock X is SX 25. Under the asset price model of log-normal returns, compute the weight of stock X needed so that there is a 67% chance that after one year (i.e. T = 1) the amount of stock X in the portfolio II is worth more than 30. (Use the information on the return to find st and the Z-table backwards.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts