Question: Problem 5 (14 Marks) The most recent dividend Blue Mountain Breweries Limited paid was $3 per share. The company expects to pay the same dividend

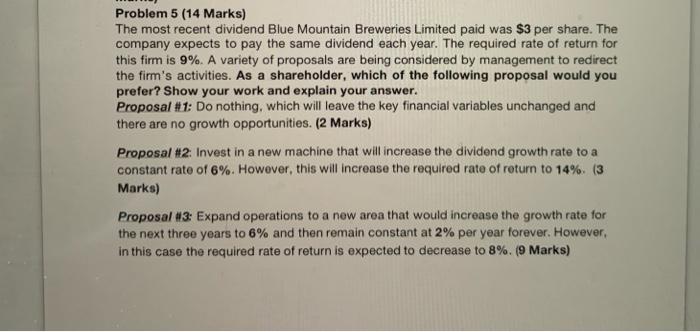

Problem 5 (14 Marks) The most recent dividend Blue Mountain Breweries Limited paid was $3 per share. The company expects to pay the same dividend each year. The required rate of return for this firm is 9%. A variety of proposals are being considered by management to redirect the firm's activities. As a shareholder, which of the following proposal would you prefer? Show your work and explain your answer. Proposal #1: Do nothing, which will leave the key financial variables unchanged and there are no growth opportunities. (2 Marks) Proposal #2. Invest in a new machine that will increase the dividend growth rate to a constant rate of 6%. However, this will increase the required rate of return to 14%. (3 Marks) Proposal #3: Expand operations to a new area that would increase the growth rate for the next three years to 6% and then remain constant at 2% per year forever. However, in this case the required rate of return is expected to decrease to 8%. (9 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts