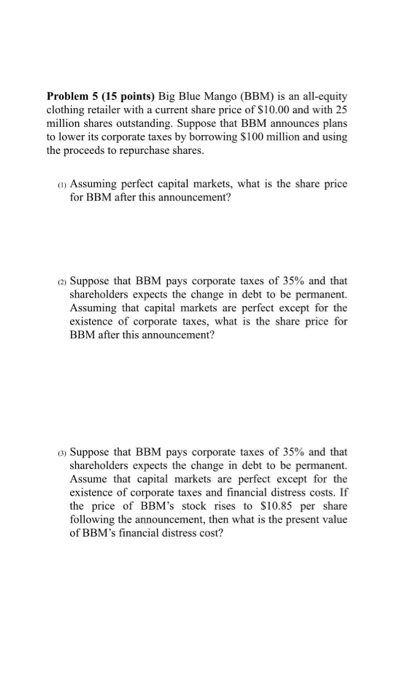

Question: Problem 5 (15 points) Big Blue Mango (BBM) is an all-equity clothing retailer with a current share price of $10.00 and with 25 million shares

Problem 5 (15 points) Big Blue Mango (BBM) is an all-equity clothing retailer with a current share price of $10.00 and with 25 million shares outstanding. Suppose that BBM announces plans to lower its corporate taxes by borrowing $100 million and using the proceeds to repurchase shares. a) Assuming perfect capital markets, what is the share price for BBM after this announcement? (2) Suppose that BBM pays corporate taxes of 35% and that shareholders expects the change in debt to be permanent. Assuming that capital markets are perfect except for the existence of corporate taxes, what is the share price for BBM after this announcement? (3) Suppose that BBM pays corporate taxes of 35% and that shareholders expects the change in debt to be permanent. Assume that capital markets are perfect except for the existence of corporate taxes and financial distress costs. If the price following the announcement, then what is the present value of BBM s financial distress cost? of BBM's stock rises to S10.85 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts