Question: Problem 5 (15 points) Suppose that you plan to buy a put option of stock A expiring after 1 year selling for $8 with exercise

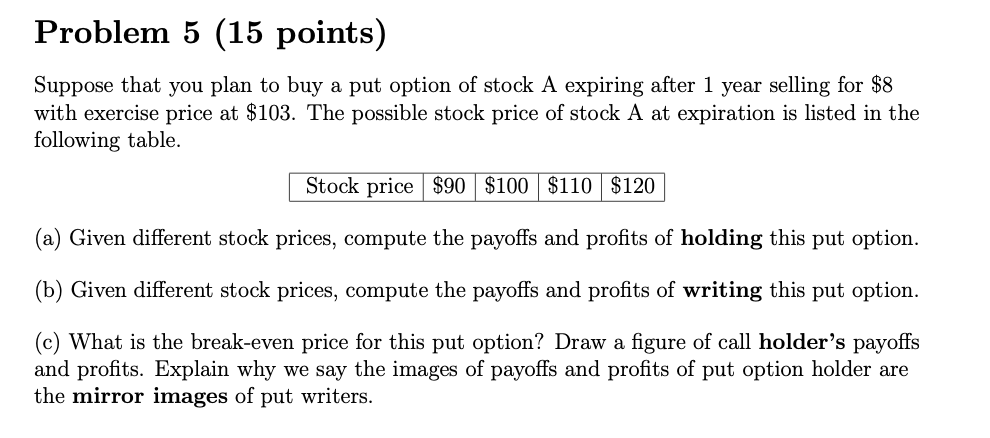

Problem 5 (15 points) Suppose that you plan to buy a put option of stock A expiring after 1 year selling for $8 with exercise price at $103. The possible stock price of stock A at expiration is listed in the following table. Stock price $90 $100 $110 $120 (a) Given different stock prices, compute the payoffs and profits of holding this put option. (b) Given different stock prices, compute the payoffs and profits of writing this put option. (c) What is the break-even price for this put option? Draw a figure of call holder's payoffs and profits. Explain why we say the images of payoffs and profits of put option holder are the mirror images of put writers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts