Question: Problem 5) (20 points): As a financial analyst you are estimating intrinsic value of Nevada Inc's shares and you are using two approaches. a) You

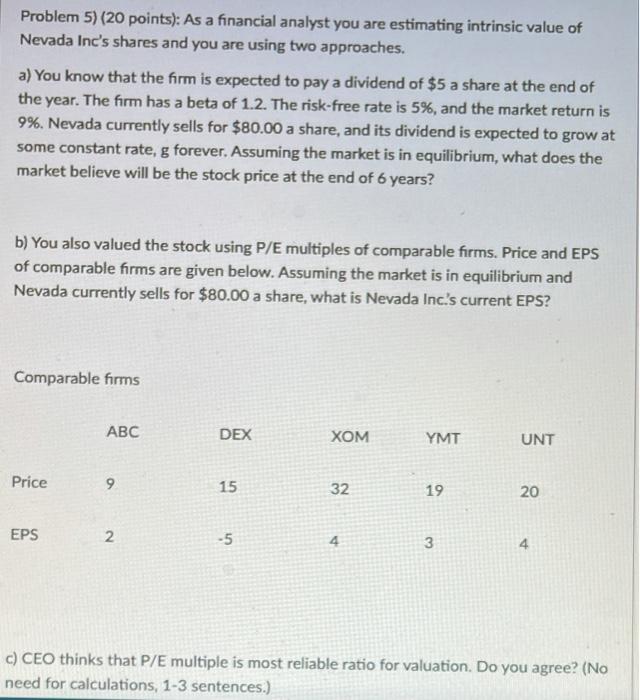

Problem 5) (20 points): As a financial analyst you are estimating intrinsic value of Nevada Inc's shares and you are using two approaches. a) You know that the firm is expected to pay a dividend of $5 a share at the end of the year. The firm has a beta of 1.2. The risk-free rate is 5%, and the market return is 9%. Nevada currently sells for $80.00 a share, and its dividend is expected to grow at some constant rate, g forever. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 6 years? b) You also valued the stock using P/E multiples of comparable firms. Price and EPS of comparable firms are given below. Assuming the market is in equilibrium and Nevada currently sells for $80.00 a share, what is Nevada Inc's current EPS? Comparable forms ABC DEX YMT UNT Price 9 15 32 19 20 EPS 2. -5 4 3 4 c) CEO thinks that P/E multiple is most reliable ratio for valuation. Do you agree? (No need for calculations, 1-3 sentences.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts