Question: PROBLEM 5 (20 points) Besides Options, you are also interested in other types of financial derivatives instruments, namely Futures. Using the LQ45 Index as the

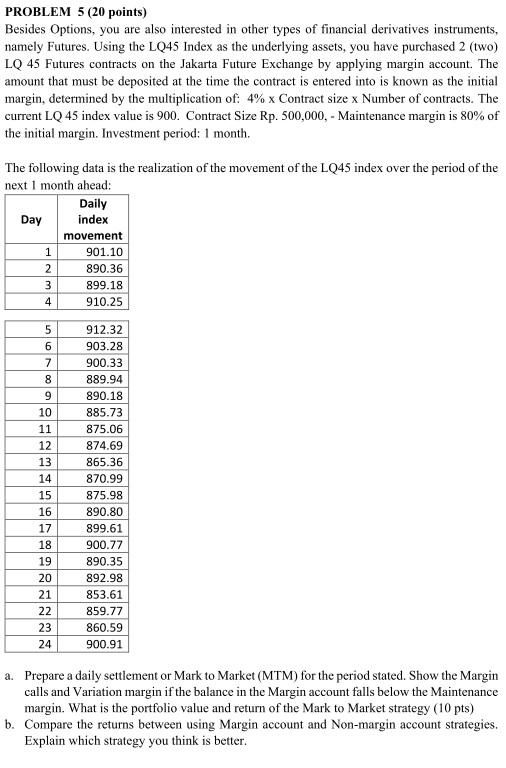

PROBLEM 5 (20 points) Besides Options, you are also interested in other types of financial derivatives instruments, namely Futures. Using the LQ45 Index as the underlying assets, you have purchased 2 (two) LQ 45 Futures contracts on the Jakarta Future Exchange by applying margin account. The amount that must be deposited at the time the contract is entered into is known as the initial margin, determined by the multiplication of 4% x Contract size x Number of contracts. The current LQ 45 index value is 900. Contract Size Rp. 500,000,- Maintenance margin is 80% of the initial margin. Investment period: 1 month. The following data is the realization of the movement of the LQ45 index over the period of the next 1 month ahead: Daily Day index movement 1 901.10 2 890.36 3 899.18 4 910.25 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 912.32 903.28 900.33 889.94 890.18 885.73 875.06 874.69 865.36 870.99 875.98 890.80 899.61 900.77 890.35 892.98 853.61 859.77 860.59 900.91 a. Prepare a daily settlement or Mark to Market (MTM) for the period stated. Show the Margin calls and Variation margin if the balance in the Margin account falls below the Maintenance margin. What is the portfolio value and return of the Mark to Market strategy (10 pts) b. Compare the returns between using Margin account and Non-margin account strategies. Explain which strategy you think is better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts