Question: Problem 5 (3 points): Jed and Mya form MY Corp. Jed transfers equipment (FMV $100,000; Basis $60,000; Subject to Debt of $50,000 ) in exchange

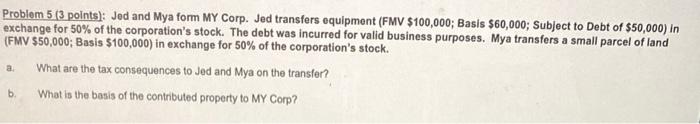

Problem 5 (3 points): Jed and Mya form MY Corp. Jed transfers equipment (FMV $100,000; Basis $60,000; Subject to Debt of $50,000 ) in exchange for 50% of the corporation's stock. The debt was incurred for valid business purposes. Mya transfers a small parcel of land (FMV $50,000; Basis $100,000 ) in exchange for 50% of the corporation's stock. a. What are the tax consequences to Jed and Mya on the transfer? b. What is the basis of the contributed property to MY Corp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts