Question: Problem 5 - 4 A ( Algo ) Lex is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid

Problem A Algo

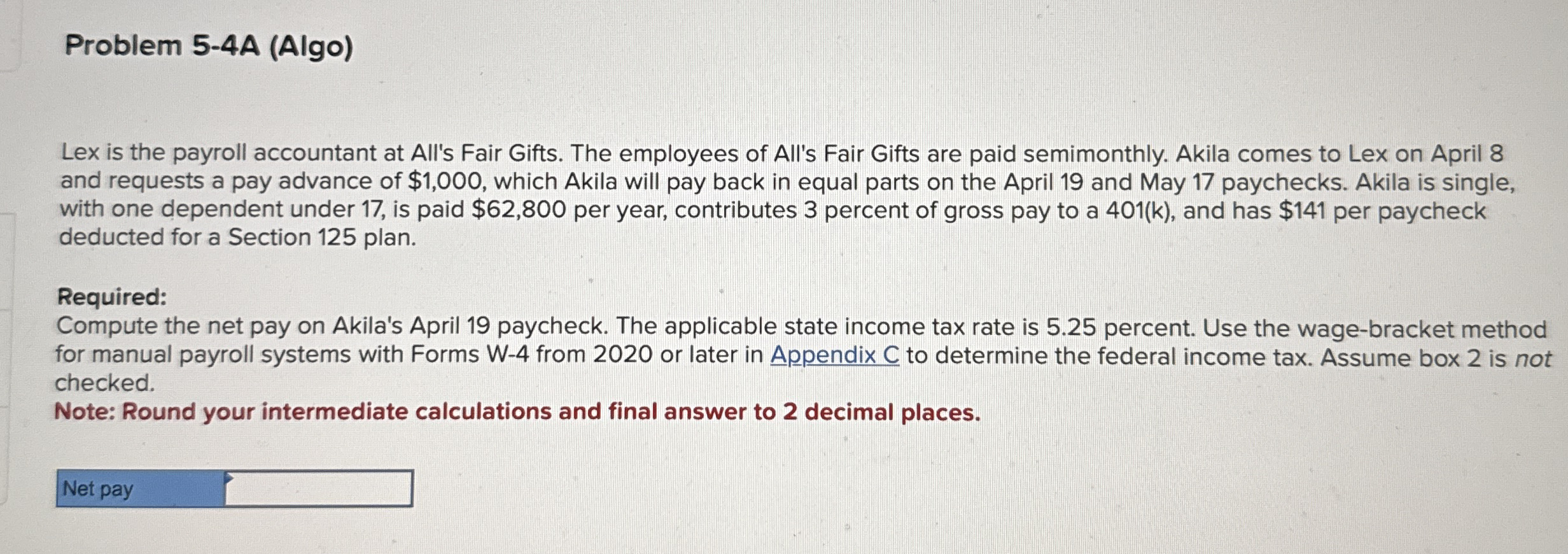

Lex is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Akila comes to Lex on April and requests a pay advance of $ which Akila will pay back in equal parts on the April and May paychecks. Akila is single, with one dependent under is paid $ per year, contributes percent of gross pay to a and has $ per paycheck deducted for a Section plan.

Required:

Compute the net pay on Akila's April paycheck. The applicable state income tax rate is percent. Use the wagebracket method for manual payroll systems with Forms W from or later in Appendix C to determine the federal income tax. Assume box is not checked.

Note: Round your intermediate calculations and final answer to decimal places.

Net pay

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock