Question: Problem 5 - 5 3 ( LO . 2 ) Starting in 2 0 1 1 , Chuck and Luane have been purchasing Series EE

Problem LO

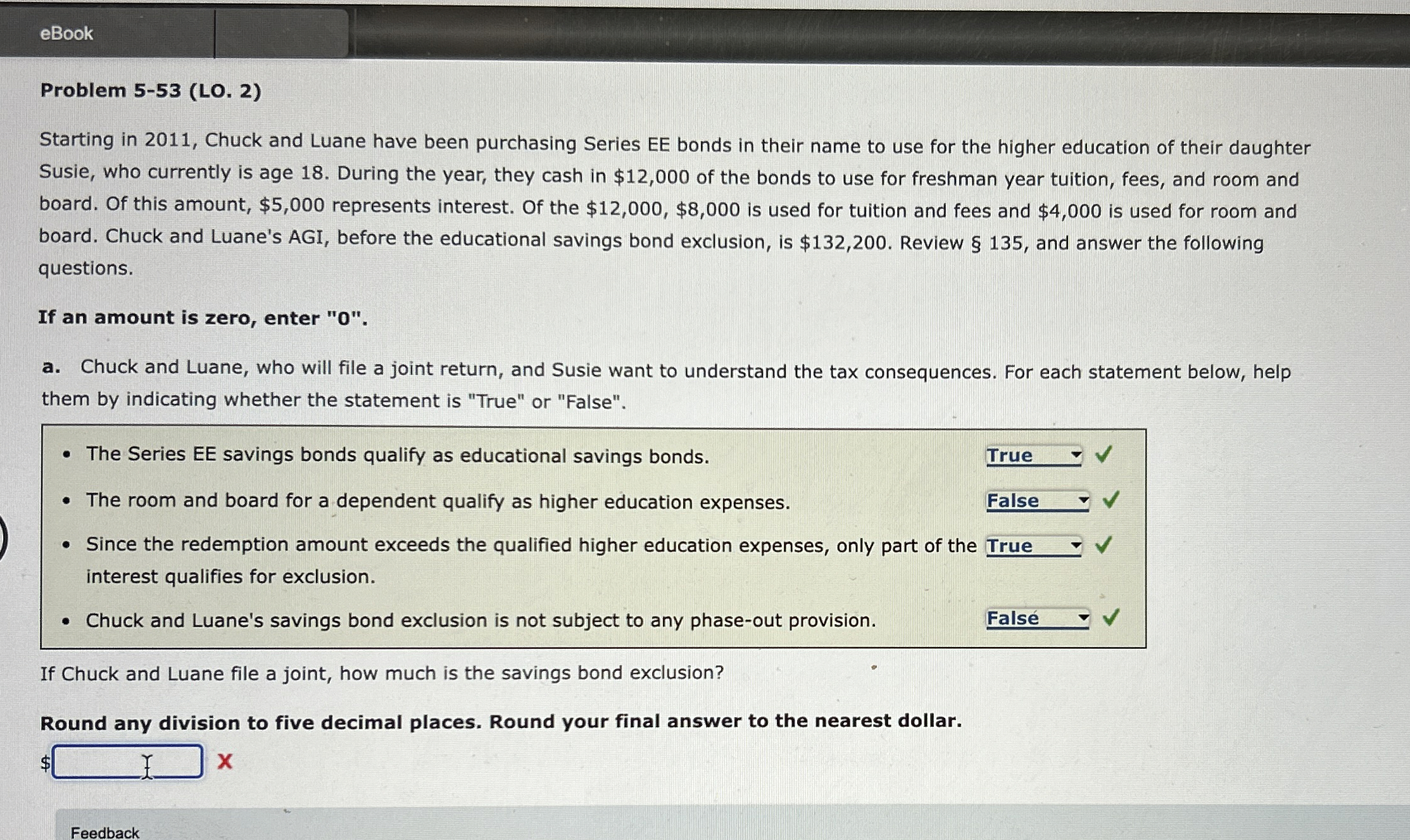

Starting in Chuck and Luane have been purchasing Series EE bonds in their name to use for the higher education of their daughter

Susie, who currently is age During the year, they cash in $ of the bonds to use for freshman year tuition, fees, and room and

board. Of this amount, $ represents interest. Of the $$ is used for tuition and fees and $ is used for room and

board. Chuck and Luane's AGI, before the educational savings bond exclusion, is $ Review and answer the following

questions.

If an amount is zero, enter

a Chuck and Luane, who will file a joint return, and Susie want to understand the tax consequences. For each statement below, help

them by indicating whether the statement is "True" or "False".

The Series EE savings bonds qualify as educational savings bonds.

The room and board for a dependent qualify as higher education expenses.

Since the redemption amount exceeds the qualified higher education expenses, only part of the

interest qualifies for exclusion.

Chuck and Luane's savings bond exclusion is not subject to any phaseout provision.

If Chuck and Luane file a joint, how much is the savings bond exclusion?

Round any division to five decimal places. Round your final answer to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock