Question: Problem 5 - 5 A ( Static ) Required: Milligan's Millworks pays its employees weekly. Use the wage - bracket tables with Forms W -

Problem A Static

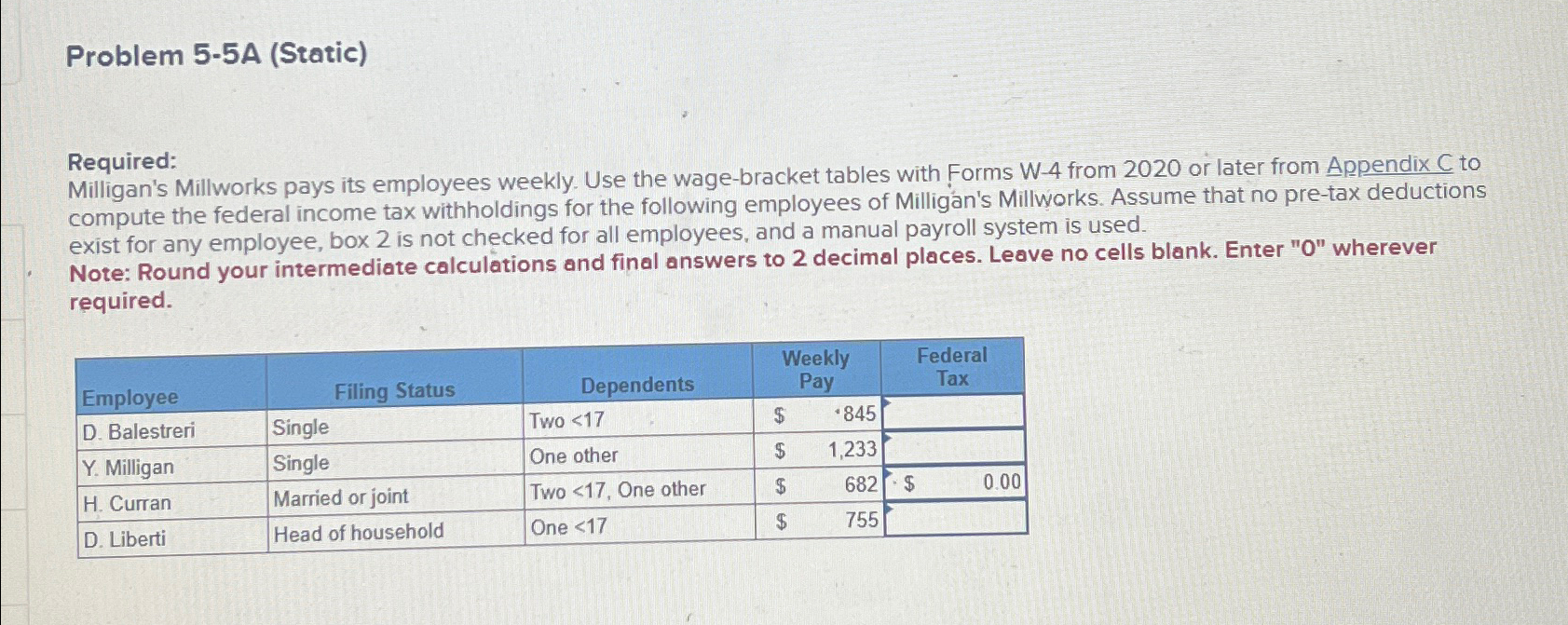

Required:

Milligan's Millworks pays its employees weekly. Use the wagebracket tables with Forms W from or later from Appendix C to compute the federal income tax withholdings for the following employees of Milligan's Millworks. Assume that no pretax deductions exist for any employee, box is not checked for all employees, and a manual payroll system is used.

Note: Round your intermediate calculations and final answers to decimal places. Leave no cells blank. Enter wherever required.

tableEmployeeFiling Status,Dependents,,aytableFederalTaxD Balestreri,Single,Two $Y Milligan,Single,One other,$H Curran,Married or joint,Two One other,$$D Liberti,Head of household,One $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock