Question: Problem 5 . 5 Use the historical simulation method described in class ( Ch . 2 2 . 2 in Hull, page 4 9 6

Problem

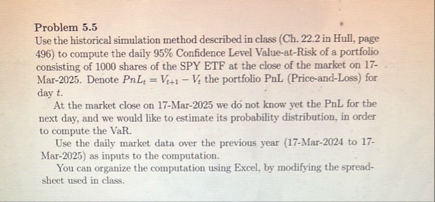

Use the historical simulation method described in class Ch in Hull, page to compute the daily Confidence Level ValueatRisk of a portfolio consisting of shares of the SPY ETF at the close of the market on Mar Denote Pn the portfolio PnL PriceandLoss for day

At the market close on Mar we do not know yet the PnL for the next day, and we would like to estimate its probability distribution, in order to compute the VaR.

Use the daily market data over the previous year Mar to Mar as inputs to the computation.

You can organize the computation using Excel, by modifying the spreadsheet used in class.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock