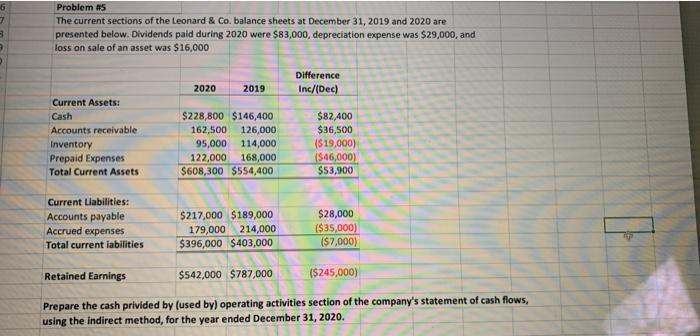

Question: Problem #5 6 7 3 The current sections of the Leonard & Co. balance sheets at December 31, 2019 and 2020 are presented below. Dividends

Problem #5 6 7 3 The current sections of the Leonard & Co. balance sheets at December 31, 2019 and 2020 are presented below. Dividends paid during 2020 were $83,000, depreciation expense was $29,000, and loss on sale of an asset was $16,000 2020 2019 Difference Inc/(Dec) Current Assets: Cash Accounts receivable Inventory Prepaid Expenses Total Current Assets $228,800 $146,400 162,500 126,000 95,000 114,000 122,000 168,000 $608,300 $554,400 $82,400 $36,500 ($19,000) (546,000) $53,900 Current Liabilities: Accounts payable Accrued expenses Total current labilities $217,000 $189,000 179,000 214,000 $396,000 $403,000 $28,000 ($35,000) ($7,000) Retained Earnings $542,000 $787,000 ($245,000) Prepare the cash privided by (used by) operating activities section of the company's statement of cash flows, using the indirect method for the year ended December 31, 2020. Problem #5 6 7 3 The current sections of the Leonard & Co. balance sheets at December 31, 2019 and 2020 are presented below. Dividends paid during 2020 were $83,000, depreciation expense was $29,000, and loss on sale of an asset was $16,000 2020 2019 Difference Inc/(Dec) Current Assets: Cash Accounts receivable Inventory Prepaid Expenses Total Current Assets $228,800 $146,400 162,500 126,000 95,000 114,000 122,000 168,000 $608,300 $554,400 $82,400 $36,500 ($19,000) (546,000) $53,900 Current Liabilities: Accounts payable Accrued expenses Total current labilities $217,000 $189,000 179,000 214,000 $396,000 $403,000 $28,000 ($35,000) ($7,000) Retained Earnings $542,000 $787,000 ($245,000) Prepare the cash privided by (used by) operating activities section of the company's statement of cash flows, using the indirect method for the year ended December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts