Question: Problem 5 (60 points). CAPM for individual stocks. WRITE THE ANSWERS (TABLES/GRAPHS/FORMULAS) BELOW. SUBMIT EXCEL AS A SEPARATE DOCUMENT TO SUPPORT YOUR CALCULATIONS. BUT I

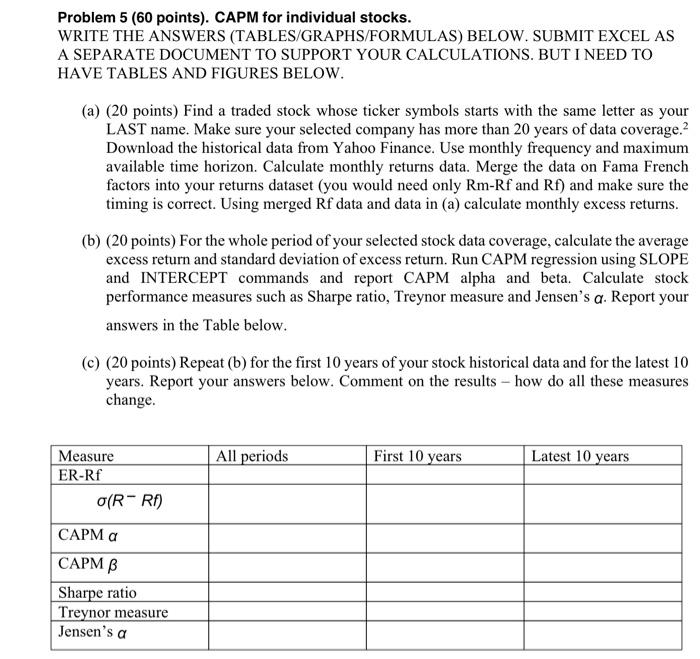

Problem 5 (60 points). CAPM for individual stocks. WRITE THE ANSWERS (TABLES/GRAPHS/FORMULAS) BELOW. SUBMIT EXCEL AS A SEPARATE DOCUMENT TO SUPPORT YOUR CALCULATIONS. BUT I NEED TO HAVE TABLES AND FIGURES BELOW. (a) (20 points) Find a traded stock whose ticker symbols starts with the same letter as your LAST name. Make sure your selected company has more than 20 years of data coverage. 2 Download the historical data from Yahoo Finance. Use monthly frequency and maximum available time horizon. Calculate monthly returns data. Merge the data on Fama French factors into your returns dataset (you would need only RmRf and Rf ) and make sure the timing is correct. Using merged Rf data and data in (a) calculate monthly excess returns. (b) (20 points) For the whole period of your selected stock data coverage, calculate the average excess return and standard deviation of excess return. Run CAPM regression using SLOPE and INTERCEPT commands and report CAPM alpha and beta. Calculate stock performance measures such as Sharpe ratio, Treynor measure and Jensen's . Report your answers in the Table below. (c) (20 points) Repeat (b) for the first 10 years of your stock historical data and for the latest 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts