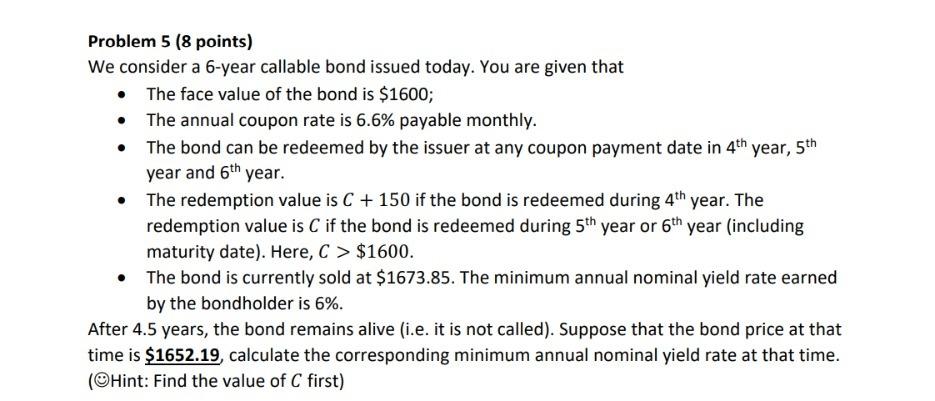

Question: Problem 5 ( 8 points) We consider a 6-year callable bond issued today. You are given that - The face value of the bond is

Problem 5 ( 8 points) We consider a 6-year callable bond issued today. You are given that - The face value of the bond is $1600; - The annual coupon rate is 6.6% payable monthly. - The bond can be redeemed by the issuer at any coupon payment date in 4th year, 5th year and 6th year. - The redemption value is C+150 if the bond is redeemed during 4th year. The redemption value is C if the bond is redeemed during 5th year or 6th year (including maturity date). Here, C>$1600. - The bond is currently sold at \$1673.85. The minimum annual nominal yield rate earned by the bondholder is 6%. After 4.5 years, the bond remains alive (i.e. it is not called). Suppose that the bond price at that time is $1652.19, calculate the corresponding minimum annual nominal yield rate at that time. (-)Hint: Find the value of C first)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts