Question: Problem 5 - 9 A ( Algo ) Calculate and analyze ratios ( LO 5 - 8 ) Assume selected financial data for Small Mart

Problem A Algo Calculate and analyze ratios LO

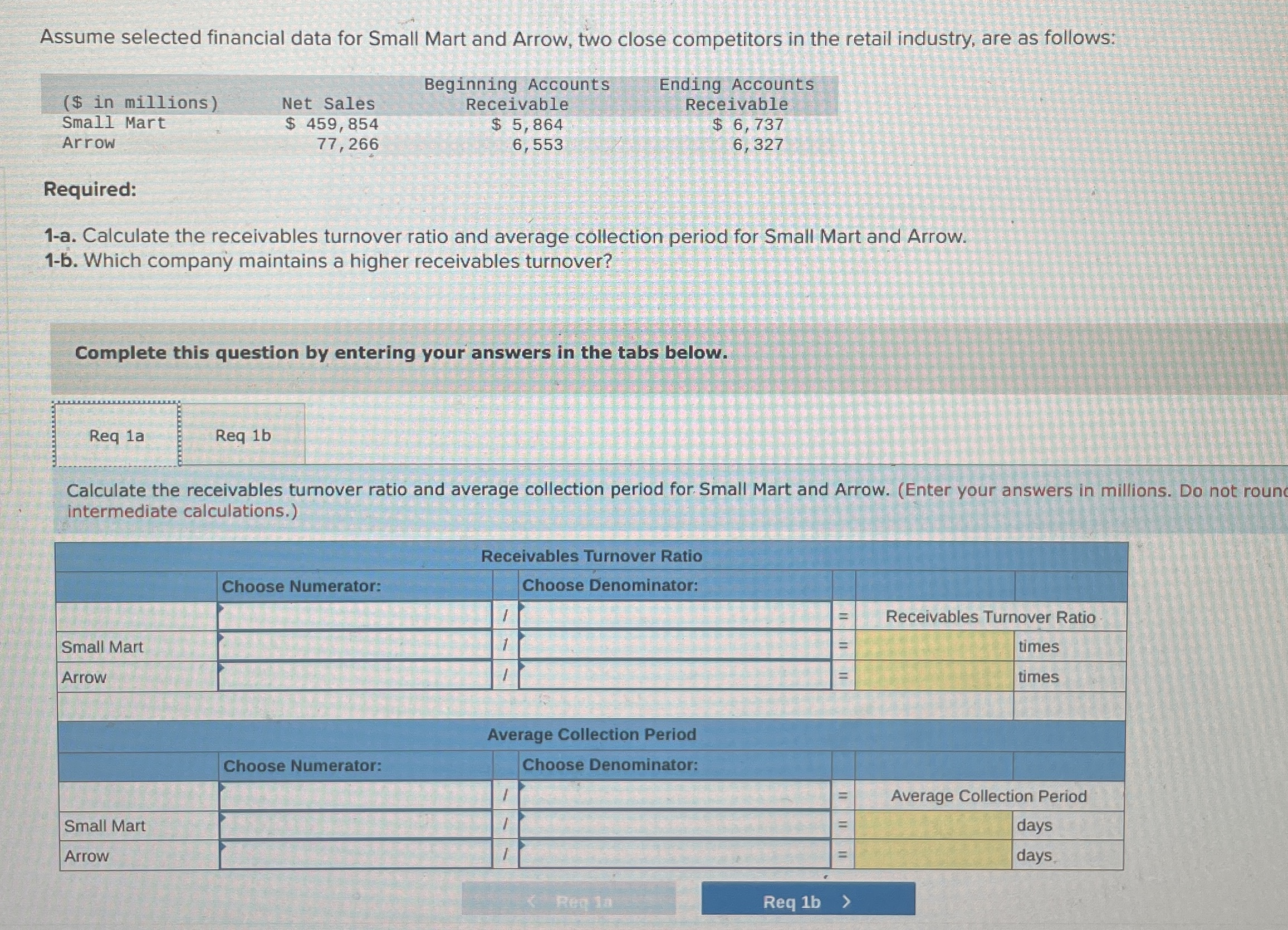

Assume selected financial data for Small Mart and Arrow, two close competitors in the retail industry, are as follows:

table$ in millionsNet Sales,Beginning Accounts,Ending AccountsSmall Mart,$Receivable,ReceivableArrow

Required:

a Calculate the receivables turnover ratio and average collection period for Small Mart and Arrow.

b Which company maintains a higher receivables turnover?

Complete this question by entering your answers in the tabs below.

Req a

Req

Calculate the receivables turnover ratio and average collection period for Small Mart and Arrow. Enter your answers in millions. Do not re intermediate calculations.

tableReceivables Turnover RatioChoose Numerator:,,Choose Denominator:,,Receivables Turnover RatioSmall Mart,,timesArrowtimesAverage Collection PeriodChoose Numerator:,,Choose Denominator:,,Average Collection PeriodSmall Mart,daysArrowI,,days

Assume selected financial data for Small Mart and Arrow, two close competitors in the retail industry, are as follows:

table$ in millionsNet Sales,Beginning Accounts,Ending AccountsSmall Mart,$Receivable,ReceivableArrow$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock