Question: Problem 5 A $1,000 par value bond was issued five years ago at a coupon rate of 12 percent. It currently has 15 years remaining

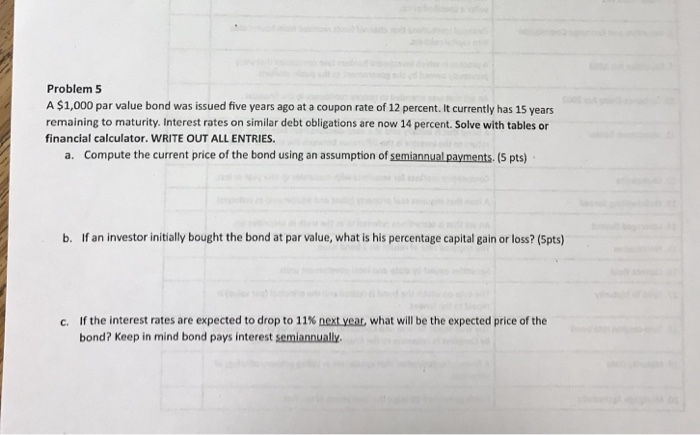

Problem 5 A $1,000 par value bond was issued five years ago at a coupon rate of 12 percent. It currently has 15 years remaining to maturity. Interest rates on similar debt obligations are now 14 percent. Solve with tables or financial calculator. WRITE OUT ALL ENTRIES a. Compute the current price of the bond using an assumption of semiannual payments (5 pts) b. If an investor initially bought the bond at par value, what is his percentage capital gain or loss? (5pts) If the interest rates are expected to drop to 11% nextvear, what will be the expected price of the bond? Keep in mind bond pays interest semiannually C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts