Question: PROBLEM 5 Adjusting Entries (12 Points) Part A: On September 1* Lakewood Wholesale Company (LWC) paid S7,500 to Denver Sales Company for rental of warehouse

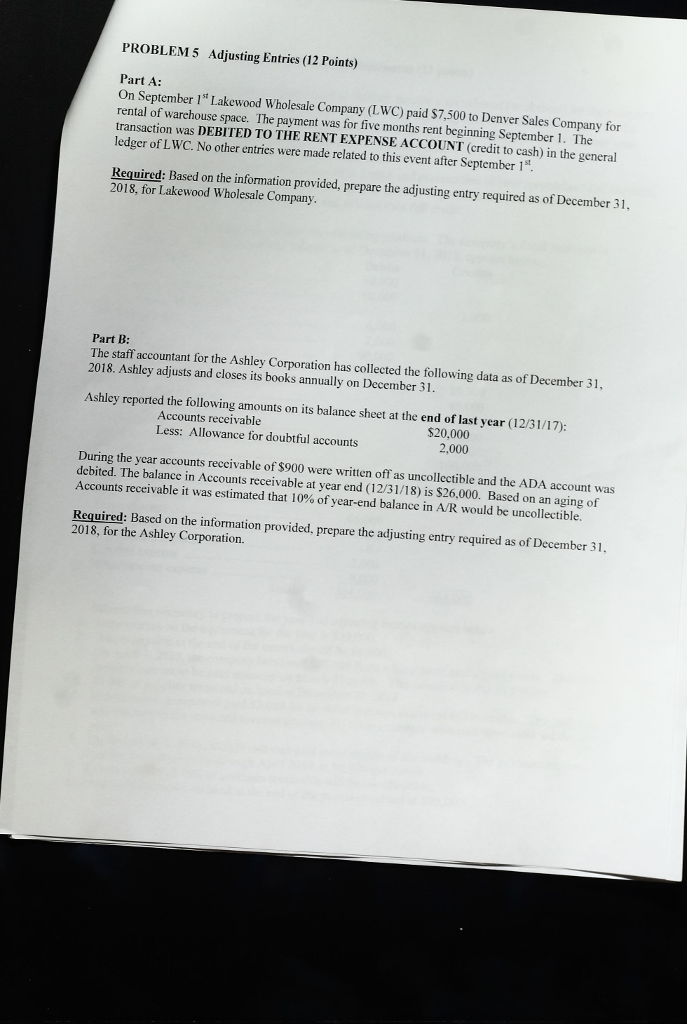

PROBLEM 5 Adjusting Entries (12 Points) Part A: On September 1* Lakewood Wholesale Company (LWC) paid S7,500 to Denver Sales Company for rental of warehouse space. The payment was for five months rent beginning September 1. The transaction was DEBITED TO THE RENT EXPENSE ACCOUNT (credit to cash) in the general ledger of LWC. No other entries were made related to this event after September 1st ased on the information provided, prepare the adjusting entry required as of December 31 Required: B 2018, for Lakewood Wholesale Company Part B: 2018. Ashley adjusts and closes its books annually on December 31 Ashley reported the following amounts on its balance sheet at the end of last year (12/31/17) The staff accountant for the Ashley Corporation has collected the following data as of December 31 Accounts receivable Less: Allowance for doubtful accounts $20,000 2,000 During the year accounts receivable of $900 were writen off as uncollectible and the ADA account was debited. The balance in Accounts receivable at year end (12/31/18) is $26.000. Based on an aging of Accounts receivable it was estimated that 10% of year-end balance in AR would be uncollectible. Required: Based on the information provided, prepare the adjusting entry required as of December 31 2018, for the Ashley Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts